Compound Foundation: Inaugural Transparency Report | December 2025

Reporting period: July 1–December 29, 2025

Author: Compound Foundation

1. Purpose of this report

Earlier this year, the Compound community chose to create the Compound Foundation, with a clear mandate: to stabilize the protocol, restore credibility and competitiveness, and build a path toward long-term relevance and sustainability.

This Inaugural Transparency Report (ITR) assesses progress against those original commitments, provides a perspective towards 2026, and outlines how the stabilization work completed to date is expected to translate into consistent execution, product delivery, and renewed growth.

The following sections mirror the Key Results and success criteria set out in the Compound Foundation proposal. While we are still in the early innings, with just a few months of operations, we intend to assess progress against those same benchmarks, while calling out noteworthy milestones accomplished in areas that we could not have predicted.

2. Executive summary

The Compound Foundation has made tangible progress against the commitments set out at its creation, despite operating under considerably tighter financial, governance, and legal constraints than anticipated, with a deliberately lean team and while responding to a combination of inherited legacy issues and unforeseen events.

During the reporting period, the Foundation focused on stabilizing the protocol’s operating environment, advancing long-standing decisions (e.g., v2 deprecation) into execution, strengthening governance coordination, and adding senior execution capacity across legal, technical, security, and partnerships functions.

These outcomes were achieved in a context of elevated complexity. Governance volatility, unresolved legal and IP constraints, and external shocks (including matters relating to Elixir and an adversarial governance incident affecting Comptroller operations) required the Foundation to divert substantial time and resources toward stabilization, risk management, and unplanned interventions.

Simultaneously, multiple initiatives intended to improve protocol economics and efficiency were executed during this period. However, the Foundation does not yet have reliable, independently-validated data to present protocol-level revenue and cost figures with confidence. Given the importance of data integrity to inform governance, this report has deliberately limited quantitative financial claims. The Foundation is in the process of strengthening internal financial and reporting capabilities, including the recruitment of a dedicated Treasurer, and will look to share preliminary findings in the first quarter of 2026.

Notwithstanding these constraints, we are encouraged by progress to date. Relative to the protocol’s position six months ago, Compound now operates from a more stable and credible footing, and we have exciting initiatives lined up for 2026 and beyond. While these developments do not guarantee success, they represent concrete improvements in the conditions required for disciplined execution and provide a stronger starting point for the work ahead.

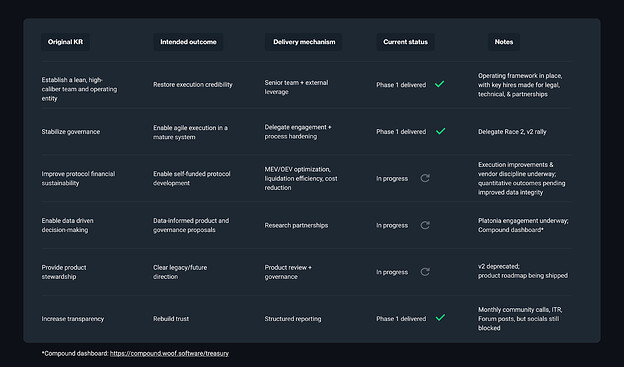

3. Original KRs: initial mandate vs current state

4. Detailed progress assessment

A. Financial discipline and sustainability

Original KR

Improve Compound’s financial trajectory and reduce reliance on structurally inefficient spend.

Progress

Progress against this KR has focused on improving the quality, resilience, and discipline of protocol execution and cost management, rather than optimizing for short-term financial outcomes.

During the reporting period, the Foundation facilitated a series of initiatives intended to improve liquidation execution and reduce value leakage, including improvements to execution quality, counterparty selection, and routing during periods of market stress. This work included execution improvements related to Maximal Extractable Value (MEV) and negotiated commercial arrangements related to Oracle Extractable Value (OEV). These initiatives were implemented using existing protocol mechanics and offchain operational arrangements, rather than protocol-level changes, in order to avoid introducing new onchain dependencies.

In parallel, the Foundation supported a number of governance-approved processes and reviews aimed at strengthening the protocol’s operational and cost foundations. This included:

-

The issuance and evaluation of RFPs across security, risk, and infrastructure providers.

-

The transition toward a more structured vCISO and security oversight model, where we designated Ioannis Sachinoglou as Compound’s first vCISO to manage all of Compound’s Security Service Partners (SSPs).

-

The introduction of Security Operations Center (SOC)-style controls and monitoring to improve visibility, accountability, and resilience across critical functions.

Together, these steps were intended to reduce operational risk, improve vendor performance, and create a more sustainable long-term cost structure.

The Foundation also supported the execution of v2 deprecation and associated parameter changes, which required careful sequencing and coordination to reduce ongoing maintenance and risk exposure associated with legacy product surfaces.

Current reality

While the Foundation believes these actions have positively influenced protocol efficiency and long-term sustainability, it does not yet have sufficiently reliable, independently-validated financial data at the protocol level to confidently present precise revenue or cost figures. This reflects limitations in existing reporting infrastructure and inconsistent performance by legacy service providers responsible for protocol financial data.

Recognizing that credible transparency depends on accurate information, the Foundation is prioritizing strengthening internal financial governance and reporting capabilities, including the recruitment of a dedicated Treasurer. The Foundation intends to provide more detailed and reliable protocol-level financial disclosures to the community once data integrity issues have been resolved, and anticipates sharing more information during the first quarter of 2026. As a result, quantitative financial claims in this report have been deliberately limited in favor of describing the concrete actions taken to improve long-term sustainability.

B. Talent and execution capacity

Original KR

Build a small, high-caliber team capable of unblocking execution and operating at protocol scale.

Progress

-

Legal, governance, and operational advisory: Christopher Donovan (Senior Advisor). Former COO and General Counsel at NEAR Foundation; UK-qualified lawyer with deep experience in protocol governance, regulatory structuring, and operational execution. Engaged to progress long-standing legal, governance, and IP constraints that have limited execution and public communication capability.

-

Technical leadership and protocol continuity: Torrey Atcitty (Technical Lead). First employee and Principal Engineer at Compound Labs, with prior experience in four start-up ventures and deep institutional knowledge of the protocol and codebase. Providing continuity, access, and technical readiness in support of future innovation.

-

DeFi partnerships and business development: Doo Wan Nam (Partnerships Lead, DeFi). Formerly in senior business development roles across leading DeFi platforms; mandated to pursue high-value, revenue-linked partnerships and represent Compound in strategic ecosystem dialogues.

-

Security oversight and risk coordination: Michael Lewellen (Security Advisor). Veteran protocol security advisor; led and coordinated RFP processes for auditor and security provider transitions, and played a central role in MEV/OEV partnership negotiations during the reporting period.

-

Additional functional engagement: senior talent across product and marketing and communications are engaged by the Foundation on a targeted basis to supplement internal capacity. Further detail on these engagements may be shared in subsequent transparency reports as appropriate.

These roles were deliberately prioritized because legal and IP constraints, technical continuity, and credible partnership execution represented the most significant constraints on progress at the time of the Foundation’s creation.

As the Foundation looks ahead to the next phase of execution, there are several areas where additional capacity would materially improve effectiveness. These include a Treasurer, Partnerships Lead (TradFi), Head of Technology, Senior Designer, Community and Social Manager, and Operations Manager. These roles may be filled through a mix of full-time hires, fractional support, or short-term engagements. As always, community members with relevant experience or references are encouraged to reach out to the Foundation directly.

Current reality

The Foundation remains intentionally lean, however, we feel the seniority and context of these hires materially improve the Foundation’s ability to convert effort into outcomes. Additionally, early partnership dialogues have been supported by targeted industry presence (e.g., a live media interview on Nasdaq TradeTalks at SmartCon) contributing to an initial pipeline of discussions that are expected to mature over subsequent periods.

C. Product and protocol stewardship

Original KR

Assume responsibility for protocol stewardship, develop a forward-looking product roadmap, and return to the community with concrete proposals once scope, sequencing, and implications are understood.

Progress

A comprehensive review of protocol surfaces was completed across v2, v3, and other experimental environments which have not achieved product market fit. Reviews were anchored around security posture, capital efficiency, and scale. As a result of this review, we quickly identified v2 deprecation as necessary; this is now in execution.

Compound experienced an extended period without any major product releases. The Foundation is working to clearly articulate the next set of priorities and design direction, informed by current market trends, user needs, and commercial opportunities. We see this as a big, bold bet on the future of Compound, especially given that any meaningful evolution of the protocol is likely to be both complex and resource-intensive.

Current reality

The next iteration of Compound represents an opportunity to transform the protocol’s trajectory by aligning product direction to powerful industry trends, executing against evolving user needs and deploying a more competitive feature set. While outcomes are uncertain and no single change is determinative, careful design choices, disciplined execution, governance alignment, and sustained community engagement are all necessary inputs to improving the protocol’s long-term prospects.

Consistent with the expectations set out at the creation of the Foundation, the intent is to return to the community with a separate governance proposal once this roadmap has been sufficiently validated. Later this week, we will anchor with our view of the current environment and vision for the next generation of Compound, and allow the community to engage and provide feedback. Once incorporated, we will follow up with scope, sequencing, resourcing, and economic rationale, and seek the community’s approval.

D. Governance and ecosystem health

Original KR

Improve governance quality, participation, and resilience, while enabling execution within a mature and complex decentralized governance system.

Progress

Compound governance reflects the realities of a mature protocol with a long operating history and, more recently, complex stakeholder dynamics. Despite this, governance activity increased relative to the pre-Foundation baseline, with 62 proposals submitted in the last six months post Foundation formalization in June this year, compared to 51 in the prior six months.

Despite periods of heightened contention, the ecosystem demonstrated the ability to coordinate around consequential decisions, including Delegate Race Round 2 and the approval of v2 deprecation. Relative to the voting participation rate before the proposal to establish the Foundation passed, voter participation and turnout increased by 30%.

These outcomes required significant coordination effort including extended delegate engagement, sequencing trade-offs, and tolerance for slower throughput, reflecting the real execution cost of operating within a mature, and occasionally volatile, governance environment.

The Foundation has worked closely with the Compound Governance Working Group (CGWG), delegates, and risk providers to support this coordination, particularly in navigating governance complexity and sequencing during a challenging period, at times stepping in to help facilitate proposal execution with temporary bridge funding when needed as the Compound ecosystem does not yet have an emergency fund — an important step as we think about our future.

Current reality

Building on this work, CGWG has indicated its intention (with support from the Foundation and other important stakeholders) to bring forward governance process and resilience updates in the early part of 2026, informed by recent governance experience and community feedback. These prospective updates are expected to focus on improving coordination, reducing friction, and strengthening the DAO’s ability to operate effectively in volatile conditions. Any such changes would be subject to Compound’s standard governance discussion and approval.

E. Research, grants, community insight, and education

Original KR

Ground decisions in data, research, and ecosystem understanding.

Progress

After working together for a quarter on several strategic initiatives, the Foundation decided to support Platonia to conduct research into Compound’s capital efficiency, APY competitiveness, and protocol positioning relative to peers. The Foundation worked with Compound Grants Program (CGP) to fund Platonia’s work; the scope includes mechanism design research, risk analysis, competitive modeling, and a framework to achieve industry-leading capital efficiency and enhanced liquidation capabilities in future product iterations. The first milestone is expected to be shared by the end of January with an implementation spec completed by the end of Q1 2026.

In parallel, broader community research efforts are underway to inform governance evolution and product design. The Foundation has also begun exploratory work on longer-term educational and advocacy initiatives involving academics and industry participants. This workstream is in the spirit of promoting Compound and the Compound Foundation’s core mission of democratizing finance and making it globally accessible. We expect to update the community on progress here in a subsequent report.

Current reality

This work is deeply intertwined with our goal of making Compound more competitive and relevant in today’s burgeoning ecosystem. Though research is still early, we are confident that it will inform critical design decisions.

F. Foundation financial position

Original KRs

Operate the Foundation with financial discipline, consistent with the funding parameters approved at creation, and provide the community with visibility into its financial position over time.

Progress

As of today, the Foundation has operated within the scope and intent of the funding approved at creation. Expenditure to date has been concentrated on core operating costs, including legal and governance support, talent, and essential operational infrastructure. The challenging market conditions adversely affected the already lean operating budget sought upon establishing the Foundation.

While we are pleased to see key talent interested in direct COMP compensation, demonstrating their belief in the future of Compound, a portion of the originally allocated COMP has been converted to stablecoins and fiat in line with the principles set out in the creation proposal, with the objective of reducing volatility risk and ensuring operational continuity.

In addition, during the reporting period the Foundation temporarily advanced capital in order to enable the execution of governance-approved proposals following an apparent griefing action that disrupted normal Comptroller operations. This action was taken to preserve the intent of prior governance decisions and ensure the continuity of protocol operations during an adversarial event, and until a more appropriate mechanism such as an ecosystem emergency fund is established. The advancement was operational in nature and did not alter governance outcomes or approvals.

In accordance with the governance proposal approving the creation and funding of the Foundation, the Comptroller was authorized to transfer approximately $9M (COMP equivalent) to support the Foundation’s operations through December 31, 2026. As disclosed at the time of approval, this funding was structured with an initial transfer of approximately $3M (COMP equivalent) following proposal approval, with the remaining approximately $6M (COMP equivalent) being disbursed via quarterly tranches during 2026.

Specifically, the approved disbursement schedule outlines four quarterly transfers in 2026, each of approximately $1.5M (COMP equivalent), expected at the start of each calendar quarter. These disbursements are intended to support continued operations within the scope, duration, and conditions set out in the original governance approval. Any such transfers will be executed strictly in line with that approved schedule and do not represent a new or expanded funding request.

The Foundation’s operating budget was intentionally structured in COMP denominated terms at the time of approval, rather than being hedged or fixed in USD. As a result, the effective operating budget has been materially impacted by subsequent movements in the COMP price, including a decline from a 30-day TWAP of approximately $44 at the time of approval to current market levels of about $25.

Despite this significant reduction in effective purchasing power, the Foundation has not returned to the community with a request for additional operational funding and has instead adjusted scope, pacing, and cost structure accordingly. Based on current operating assumptions, the Foundation remains hopeful it can complete the originally contemplated ~18-month operating mandate within the approved funding envelope, subject to market conditions, future governance decisions, and any additional unforeseen ecosystem disruption.

This approach reflects a deliberate choice to prioritize cost discipline and execution within approved parameters.

Current reality

The Foundation intends to provide high-level updates on its financial position twice a year, including runway and major spend categories, as part of future transparency reports. Any material changes to funding requirements would be brought to the community through separate governance processes.

5. Operating through legacy debt and ecosystem complexity

A defining feature of the Foundation’s first operating period has been the need to work through layers of legacy debt and ecosystem complexity that materially shaped what was and is possible, and the execution timeline for a true protocol resurgence. This context is important to adequately explain the constraints and sequencing logic under which outcomes to-date have been delivered.

The Foundation inherited a protocol and governance system with significant path dependency. Outdated product surfaces, legacy governance processes, unresolved legal and IP matters, and strained stakeholder relationships all impose real execution costs. Addressing these issues is a prerequisite for forward progress, even where the work itself is not externally visible due to the sensitivity of some of those matters.

One visible consequence of this inherited legal and operational complexity has been the Foundation’s limited ability to expand public presence, including control of social media accounts and communication channels. Working through these matters has required careful legal sequencing and coordination, and progress has been non-linear. As a result, the Foundation has at times been constrained in its ability to communicate publicly at the cadence it would like, despite active work underway to resolve these issues.

The Foundation has also been required to respond to unexpected and resource-intensive events, most notably matters relating to the DAO decision to introduce Elixir into the Compound ecosystem in 2024, and an episode that disrupted normal Comptroller operations. While some details remain constrained by legal considerations (particularly regarding Elixir, although we hope the continued efforts by the Foundation and Gauntlet will generate good news to share soon), these events demanded substantial attention, unplanned expenditure, and operational focus. The Foundation approached these situations with the objective of doing what it believed to be in the best interests of the DAO. The Foundation did so recognizing that stepping into difficult and potentially adversarial circumstances was necessary to protect governance intent and longer-term ecosystem health, even when this work fell well outside the perimeter originally outlined at the Foundation’s formation.

In summary, a substantial share of the Foundation’s time during the reporting period has been directed toward reducing drag, restoring execution capacity, stabilizing legal and operational foundations, and rebuilding relationships and trust with contributors and partners. This work does not map cleanly to short-term metrics, but it influences the probability that future initiatives can be more seamlessly executed.

6. Why the Foundation believes the plan is executable

The Foundation’s conviction rests on observable changes in operating conditions. Protocol economics improved prior to new product launches, structural costs were reduced rather than deferred, senior operators with deep protocol context are now in place, research is informing decisions, and the product surface has been rationalized, laying the groundwork for Compound’s resurgence.

These factors materially improve the probability of disciplined execution as compared to the conditions of Compound six months ago.

7. Forward focus (2026 and beyond)

The next phase shifts the protocol onto its front foot: weighing the merits of the forthcoming roadmap and executing against it, forming and deepening partnerships that can translate into protocol-level usage and revenue, continuing to strengthen governance resilience informed by recent experience, and further expanding transparency and public visibility once legal and IP constraints can be lifted.

The Foundation intends to publish transparency reports on a bi-annual basis, aligned to meaningful execution milestones and governance cycles. In addition to these reports, the Foundation will continue to engage with the community as it has been through regular Forum updates, community calls, and direct working channels with delegates and service providers, with the objective of maintaining an ongoing two-way dialogue.

The Foundation views transparency and communication as a shared process and encourages delegates and community members to actively leverage these channels to raise questions, provide feedback, and contribute perspectives as work progresses. Interim updates will also be provided where material events warrant doing so. We will devote a portion of our January community call to discuss any feedback or questions on this report, and look forward to hearing your perspective.

As we close the year, the Foundation would like to sincerely thank the Compound community and the DAO for the trust, patience, and support shown throughout this period. While the path forward will require sustained effort and discipline, we believe the groundwork now in place creates a genuine opportunity to build, together with the community, a stronger and more durable future for the Compound protocol.

Disclaimers

Consistent with how we have been delivering our monthly community updates, we attempt to anchor statements in data. Where data is still being finalized or validated, this is stated explicitly. Except where explicitly stated, references to future execution, product delivery, or growth do not imply any pre-approved funding or authority and would be subject to separate governance processes. Certain statements in this report reflect forward-looking expectations and intentions based on current information and assumptions; actual outcomes may differ due to governance decisions, market conditions, legal constraints or other factors beyond the Foundation’s control.

Data integrity and reporting

During preparation of this report, the Foundation identified material limitations in the accuracy and consistency of protocol-level financial data produced by existing service providers. Given the importance of reliable information to inform governance, the Foundation has chosen to prioritize data integrity and will provide updated, validated protocol-level financial disclosures to the community once appropriate controls, ownership, and internal capability are in place.