Product Research Service Provider Proposal

Summary

Platonia’s primary objective is to deliver product research to the Compound DAO that advances Compound’s long term future while fortifying its competitiveness in the present state. This includes technical designs for Compound V4, quantitative analysis of protocol proposals, and practical, actionable recommendations aligned with Compound’s strategic growth objectives. We see this as essential to maximizing and aligning existing efforts across growth initiatives, protocol development, and risk management.

Background

Compound played a pivotal role in the early development of DeFi lending dating back to 2018, establishing itself as the leading protocol and introducing key innovations such as widely adopted p2pool lending, automated interest rate curve, Governor Bravo, and liquidity mining. While the protocol has continued to evolve with incremental improvements since the deployment of Compound III, its market share has declined. During this period, Aave V3 captured a significant share of the market, along with newer protocols offering novel designs, such as Morpho, Fluid, and Euler. With Aave V4 efforts already underway, it is crucial for Compound to invest in a protocol upgrade to meet the demands of an increasingly competitive lending landscape.

Operationally, unlike protocols with dedicated core development teams driving crucial technical initiatives, Compound Labs’ leading members have transitioned to other projects, leaving no protocol roadmap and a dearth of expertise for a large scale technical overhaul. While service providers such as Gauntlet, AlphaGrowth, WOOF!, and OpenZeppelin have stepped up to deliver on risk management, growth initiatives, smart contract development, and auditing, their primary focus remains on specific areas within their expertise as outlined in their service agreements.

Gauntlet excels in quantitative risk management, parameter optimization and vault curation, but expanding their role to core protocol research would represent a significant shift from its current mandate. AlphaGrowth has been engaged in business development for Compound, limiting their bandwidth for quantitative analysis and mechanism design. As the engineering team, WOOF! has largely devoted their cycles towards efforts such as market expansion and Sandbox development rather than deep protocol R&D. OpenZeppelin sets the standard for on-chain security, but their work centers on mitigating smart contract vulnerabilities rather than economic design.

Platonia aims to fill this gap by providing dedicated research and technical design capabilities that complement the existing specializations of service providers, ensuring Compound is well-positioned for sustained growth and innovation.

Why Now?

As @cylon framed here, Compound is facing some choices regarding it’s future

Compound can compete in several ways such as

- Sharp execution on growth strategy (distribution, marketing etc)

- Utilizing external curators to actively reallocate lending supply tiered by user risk segmentation to optimize for risk adjusted yield

- Having the best design along the axes of capital efficiency and risk management

Looking into some of these options

Growth

Aave is the clear winner on this front by most conceivable metrics. They have been extremely aggressive competitors with efforts such as orchestrating the Sonic deployment rug as pointed out by @bryancolligan and have a history of such behavior with other chains and builders. This presents difficulties for the strategy of jostling to be first movers on new chains, not to mention the substantial costs AlphaGrowth and WOOF! brought up in engineering cycles, auditing budget etc for these deployments in the latest developer community call.

TVL is an imperfect metric but a reasonable surface level proxy of growth. Looking at the data over the past year

we can see that Compound’s TVL has been stagnant while Aave’s has steadily risen and new competitors such as Morpho and Fluid have grown substantially. This trend is clearer when isolating for growth rate[1].

In a 10 month span where Fluid’s TVL rose nearly 3x, Morpho’s more than doubled and Aave’s rose 75%, Compound’s TVL growth has been a modest 10%.

There are a lot of potential reasons behind this worrisome trend. If Aave’s growth can be partially attributed to their business practices then Morpho and especially Fluid’s gain in popularity likely comes from their protocol design. In their cases, offering the best capital efficiency has been critical to finding product market fit whereas Compound hasn’t had a version upgrade in ~2.5 years. While it’s not infeasible for growth strategy to succeed in isolation, efforts there have clearly been hampered by the protocol limitations of Compound III.

Curation

The DAO has voted to move forward with the Compound Morpho Polygon collaboration. This partnership gives Compound more runway in terms of time which is needed to make strategic decisions or execute on projects such as protocol upgrades. Deploying on Polygon is a worthwhile experiment to see if Compound can gain more TVL in the near term by leveraging Morpho’s design and resources but it is far too early for that to be the clear end all be all solution. In the meantime, new lines of business should be pursued and other options explored.

Protocol Design

In terms of technical design, at the current moment

- Aave has the best oracles and protocol safeties such as CAPO and killswitch

- Morpho has the best lending model to utilize external intelligence via curators

- Fluid has the highest capital efficiency, largely due to their liquidation mechanism

though these are all subject to change given the rapidly evolving space.

Raising collateral factors has long been a topic of discussion but in a remarkably short span Fluid has pulled ahead in the race.

In particular, when comparing the collateral factors and liquidation penalties across Fluid, Morpho, Aave V3 and Compound III, Fluid offers the highest leverage and lowest penalties to users whereas Compound III has the lowest leverage and highest penalties.

As a clarification, collateral factors for other protocols are closer to liquidation factors on Compound III. This is because typically a user can open a loan borrowing up to the collateral factor and then withdraw collateral up until the liquidation factor. On Compound III, the CF is a strict cap in borrowing power since there is an explicit check preventing this here. We could be wrong, but we don’t see anything in Fluid or Aave’s contracts that prevents this behavior. While this is a reasonable safety, it does limit the maximum capital efficiency Compound III can offer to more sophisticated users. Now examining the current liquid market

For WETH correlated collateralized stable borrow we have

| Protocol | Collateral | Borrow | CF | LP |

|---|---|---|---|---|

| Fluid | WETH | USDC | 0.92 | 0.01 |

| Morpho[2] | wstETH | USDC | 0.86 | 0.0438 |

| Aave V3 | WETH | USDC | 0.83 | 0.05 |

| Compound III | WETH | USDC | 0.83 | 0.05 |

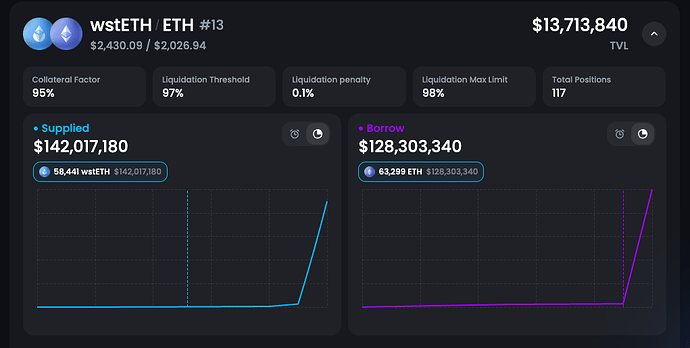

For wstETH collateralized WETH borrow for looping we have

| Protocol | Collateral | Borrow | CF | LP |

|---|---|---|---|---|

| Fluid | wstETH | WETH | 0.97 | 0.001 |

| Morpho | wstETH | WETH | 0.965 | 0.0106 |

| Aave V3 | wstETH | WETH | 0.955 | 0.01 |

| Compound III | wstETH | WETH | 0.9 | 0.03 |

Given this advantage, Fluid’s TVL growth becomes more clear and it’s no surprise Fluid is moving quickly to expand as seen in their push for deployment on Polygon fast following the Morpho proposal.

While Fluid’s advancements in DeFi capital efficiency are impressive compared to historical standards, our team’s deep experience in risk management from quantitative trading in TradFi gives us strong conviction that there remains significant room for improvement. We believe that a collaboration between a strong research team and a cracked development team can out-execute competitors on better risk parameters and drive TVL growth similar to what Fluid has achieved of late.

When considering Compound’s existing efforts with Sandbox, we have some reservations based on what is publicly available on the forums and community calls though readily acknowledge these are likely outdated

- We offered feedback on Sandbox and Compound III but key open questions around Sandbox have remain unaddressed for more than a month and there is no reported change in liquidation design from Compound III thus far despite the downsides brought up in our analysis here

- Initiatives like adding CAPO or killswitch without fixing the liquidation design seem suboptimal since achieving feature parity on oracle safety with Aave still doesn’t enable matching their risk parameters (and they are 3rd in this race)

This is more to say that we believe there should be tighter collaboration and feedback loops between researchers and developers to maximize ROI on scarce smart contract engineering cycles.

@dmitriywoofsoftware stated here that WOOF!'s technical vision for Compound’s future is coming this week and we would like to be heavily involved in the discussion.

Closing Thoughts

Growth has been challenging, but the current product has made it even harder to compete. It’s unclear whether even the best execution team in the world could have succeeded under these conditions. Since improving protocol design allows a growth team to compete on a more level playing field but growth efforts alone cannot fix underlying design flaws, protocol design should come first or be a higher priority if pursued in parallel.

While the DAO has voted to explore a partnership with Morpho, we believe this does not preclude Compound from investing in its own upgrades.

@cmrn has posted a temperature check for Compound V4, an undertaking which we see as the most critical initiative for Compound’s long-term success.

We’ve already drafted a significantly improved liquidation design for Compound—one that surpasses Fluid’s and would enable higher collateral factors and lower liquidation penalties. We’re excited to share this with the community soon.

A strong design alone won’t immediately lead to Compound taking top market share, given the importance of growth, execution, and other factors in this infinite game. However, it ensures that Compound is no longer playing catch-up on product quality, avoids spending development cycles on a flawed framework, and creates a solid foundation for growth efforts.

With Compound’s brand, treasury, and TVL combined with an improved design, we believe the protocol can reclaim its position as the premier DeFi lending platform.

Proposed Solution & Scope

Platonia proposes a strategic partnership with Compound DAO to spearhead its technical quantitative initiatives and revitalize protocol development. Our approach encompasses:

Key Partnership Areas

- Partnering with growth team(s) to refine the technical details of strategic growth initiatives, ensuring quantitative rigor and practical implementation.

- Collaborating with smart contract development team(s) to ensure all new features are economically sound, strategically aligned, and optimized for protocol objectives.

- Working with risk manager(s) to develop and align risk frameworks for all proposed protocol upgrades, ensuring security and stability. On a best efforts basis, secondary review of risk parameterization and analysis, if requested by the community.

- Coordinating with security auditor(s) to validate the safety of design choices from a smart contract vulnerability perspective.

- Leading the exploratory research and design of Compound V4, specifically addressing the structural limitations of Compound III that impede protocol scalability and future innovation while incorporating feedback from the community and important stakeholders.

Pillars of Service

Our services are structured around two core pillars to deliver comprehensive value:

Protocol Research & Development

Product Innovation & Mechanism Design

- Proposing innovative features, structured products, and revenue-generating mechanisms designed to expand Total Value Locked (TVL) and drive user adoption.

- Designing protocol mechanisms that maximize capital efficiency with Compound’s established risk tolerance (e.g., aggressiveness vs. insolvency buffer) and long-term sustainability objectives.

- Increasing COMP token utility through new features or upgrades to existing functionality.

Comprehensive DeFi Lending Market Analysis

- Conducting in-depth analysis of the competitive DeFi lending market to directly inform market expansion strategies, feature prioritization roadmaps, and the architectural design of V4.

- Defining clear, measurable success metrics and proactively identifying untapped market opportunities to guide and optimize Compound’s market expansion strategy.

Compound V4 Research & Design

- Identifying actionable feature development opportunities for Compound V4, based on market analysis and future-forward thinking.

- Generating high-level specifications for V4, actively soliciting community feedback, and iteratively refining designs based on community input to ensure alignment and buy-in.

- Developing prototypes, test suites and simulations to facilitate seamless handoff of the design specifications to the development team as needed.

Quantitative Evaluation of Business Opportunities

Proposal Evaluation

- Providing objective evaluations of governance proposals focused on protocol mechanics enhancements and the technical aspects of ecosystem growth initiatives, such as Sandbox development and structured products.

- Employing rational choice theory in our analysis and conducting scenario evaluations on edge cases to support Compound’s long-term sustainability and proactively mitigate design risks. An example would be choosing an oracle provider for OEV recapture.

This dual approach, focusing on both immediate competitiveness through V3 refinement and partner support, and long-term vision through V4 development, positions Compound for sustained success. While Platonia maintains a flexible timeline to adapt to evolving DAO priorities, we are committed to transparent communication and a collaborative approach that maximizes value creation for partner teams and the broader Compound community.

Out of Scope

- Proposal evaluation for non-technical growth initiatives (e.g. marketing campaigns)

- Smart contract development

- End-to-end Compound V4 development

- Risk parameter updates

- Incentive optimization

Platonia is available for secondary review of risk parameterization and risk analysis on a best efforts basis, if requested by the community. Though this is not our preference and we feel this is not a need for Compound at this moment.

Projects

Given the rapid industry evolution and the need for timely decisions regarding a protocol upgrade, we propose the following 30/60/90-day plan:

- Within 30 days: Deliver a quantitative analysis of existing market solutions.

- Within 60 days: Provide comprehensive research on novel features we’ve been developing.

- Within 90 days: Present an initial functional specification for Compound V4 for community review. At this stage, we anticipate extensive community feedback, which will iteratively refine the specs to a version ready for implementation. Due to inherent uncertainties, setting firm deadlines beyond this initial specification is challenging. However, given the urgency, we are fully committed to reaching this milestone as swiftly as possible.

Throughout this initial three-month period—and increasingly afterward—we will support product research by quantitatively evaluating new business opportunities, such as:

- Establishing objective frameworks for selecting an OEV solution

- Mechanism design research for new products e.g. AVS insurance h/t @rossgates

We remain committed to collaborating closely with other service providers on iterative design improvements and, where necessary, developing prototypes complete with a test suite and research simulations.

Additional details can be found in the following project table.

| Project | Description | Deliverables | Due Date |

|---|---|---|---|

| Lending Protocol Mechanism Analysis | Quantitatively analyze the mechanisms utilized across various lending protocols and document the trade-offs associated with different design approaches. Platonia will prioritize analyzing mechanisms with the highest potential impact, focusing on critical components such as liquidation mechanism, OEV, interest rate curve models, and system architecture. | Long form research post | 30 days |

| Mechanism Design | Propose novel mechanisms that exceeds state-of-the-art performance benchmarks. Develop comprehensive design documentation and rigorous quantitative analysis to validate the mechanism’s feasibility. | Design Documentation, Custom analysis of new mechanism | 60 days |

| Compound V4 - Design I | Develop a comprehensive functional specification for Compound V4, integrating insights from prior research and technical analysis. Platonia will then share the draft specification to the community for review, actively soliciting stakeholder feedback to refine the specification iteratively. | Initial functional specification | 90 days |

| Compound V4 - Design II | Develop an implementation-ready technical design document derived from the finalized functional specification. | Technical design document | ASAP pending community feedback |

| Compound V4 - Prototype | Develop a modular prototype, comprehensive test suites, and robust simulations to enable smart contract developers to seamlessly develop and validate their implementations. | [as needed] Prototype, test suites and simulations | ASAP as needed |

| Quantitative Evaluation of Business Opportunities - Proposal Evaluation | Provide objective evaluations of protocol enhancement proposals and the technical aspects of growth initiatives to support Compound’s long-term sustainability and proactively mitigate design risks. | Forum posts | Continuous |

Reporting

Bi-weekly update on the Compound forum or in the Compound developer community call

Notes

- Given the nature of research, the project scope carries some uncertainties. For instance, research findings may sometimes suggest that a feature should not be implemented. In such cases, we will not proceed with implementation just to fulfill the scope. Additionally, the scope itself may evolve as new opportunities arise or priorities shift, but we will keep the community informed of any changes.

- The overall scope includes ongoing quantitative evaluation of business opportunities, which may require reallocating time from long-term mechanism design projects. In such a scenario, these projects could be delayed.

- We recognize that our work is interconnected with existing service providers. We will proactively communicate and coordinate with Gauntlet, AlphaGrowth, WOOF!, OpenZeppelin and any other contributors to ensure smooth collaboration and address any potential bottlenecks promptly.

Cost

We propose an annual fee of $420,000, which is reflective of the value we are confident in delivering to the protocol. The fee structure breakdown would be

- $140,000 worth of COMP (based on 30-day TWAP price at the time of proposal) paid via a year-long Sablier stream

- $140,000 worth of COMP (based on 30-day TWAP price at the time of proposal) will be transferred from Compound directly to Platonia

- $140,000 is paid in USDC via Llamapay and Aera, and streamed linearly to Platonia over a year.

We believe that accepting the majority of our fee in COMP aligns directly with our efforts towards Compound’s future success. In addition, we do not plan to use COMP payments for governance voting unless requested by other members of the community.

Team

See our previous introduction post for more details.

Next Steps

We welcome any feedback on this proposal and will submit a formal on-chain proposal once all feedback has been incorporated. We are ready to begin immediately upon approval.

Additional Resources and References

Selected work from our collective DeFi experience

Compound Forum Participation

- Collateral Factors: How to Win the Lending Race

- COMP Everywhere

- [RFC] Compound Rate Stabilization Vault

- [WOOF!] Sandbox Development Updates

- [Nextosi] Contracts that enable Uniswap LP tokens as Collateral on Compound

Mechanism Design & Research

- Aera whitepaper, derivatives for Aera

- Synchronicity price adapter killswitch functionality for LST emode

- An Analysis of Uniswap Markets

- Feedback Control as a new Primitive for DeFi

- DeFi Liquidity Management via Optimal Control: Ohm as a case study

Protocol Assessment & Optimization

Market Risk Initiatives

- Risk Summit Economic Resilience: Thriving amidst Exploits and Market Volatility

- Aave resilient through USDC volatility

- Aave liquidation retrospective

- USDC.e Initial Migration Report for the Arbitrum Foundation

Contact Information

- Victor Xu: victor@platonia.xyz

- Watson Fu: watson@platonia.xyz

- Hsien-Tang Kao: ht@platonia.xyz

The cumulative growth rate is calculated over weekly rolling averages of USD TVL. This is plotted over 300 days rather than a year to coincide with when Fluid’s TVL gain stabilizes. The full year is noisier due to Fluid’s explosive 6x growth in TVL starting from a small 40M protocol in March 2024 to 240M by the end of April ↩︎

Technically there is a 0.915 CF and 0.0261 WETH USDT market but it has 0 borrow and <500k supplied ↩︎