Compound Strategy & Growth Proposal

Summary

Alastor and web3 Studios (“w3s”) propose to collaborate on the revitalization of Compound DAO through strategy and growth initiatives and establishing accountability structures.

Leveraging our multidisciplinary team with experience contributing to projects such as Uniswap, Lido, and others, we aim to re-establish Compound as a leader in the DeFi lending market.

State of Compound

Compound has fallen behind.

Compound’s market share has declined from a peak of 60% in March 2021 to approximately 8% today. Despite the potential of Compound III, adoption has lagged behind competitors like Aave. This decline can be attributed to a missing strategic direction, lack of full-time developers working for the DAO and limited efforts on user or contributor growth.

Source: DefiLlama, CoinGecko.

While we are excited about Compound III’s potential, its adoption has lagged behind the competition. Compound has not gained much ground on Aave since Compound III’s deployment in Aug 2022, with Aave v3 total borrowing currently at ~2.5x the levels seen on Compound III (~$1.1b vs. ~$450mm as of July 2023).

How Did This Happen?

Other lending protocols have continued to innovate, build out partnerships, and adapt to changing markets.

The importance of a comprehensive, well-orchestrated strategy cannot be understated. Aave, for example, was a small newcomer less than two years ago but has managed to carve out a large share of the market. Key to its success has been the ability to carry out a multi-chain strategy and to quickly add important new assets like stETH. This can be seen by looking at Aave’s treasury: 50% of its non-native token treasury ($18M of $36M) is made up of fees received on Polygon, Avalanche, and Arbitrum. stETH was added by Aave in Feb 2022 and has represented 10-20% of deposits since, generating significant economic activity on LSDs that Compound wasn’t able to rival until three months ago when Compound III cWETH was deployed. Aave has established itself as a market leader by pursuing partnerships aggressively, expanding its asset list, growing on multiple chains, and innovating (popularizing flash loans, deploying Aave v3, introducing GHO stablecoin).

Similarly, MakerDAO’s continued market share expansion can be largely credited to its proactive strategy and commitment to building strong partnerships. It has been a significant lending protocol from day one and has continued to expand market share. As a result, DAI has proliferated and has nearly 5x’d the outstanding supply since the beginning of 2021.

There are also new protocols eating up market share with their own unique spins on how collateralized borrow/lend should work. Some examples include Euler, Morpho, and Ajna.

Contrarily, Compound’s lack of strategic focus and emphasis on development has led to a stagnation of growth. Without a strategic direction, the protocol risks losing relevance in the rapidly evolving DeFi landscape. It currently has 0 developers on its payroll, and only a few part-time contributors occasionally doing one-off development work but without much coordination between each other and lacking a long-term direction. There is no unified source of Compound development priorities and little structure to ensure progress is made. Additionally, there are few focused efforts on user or contributor growth.

As the current Compound Grant Program (CGP 2.0) draws to a close, it provides an opportune moment for reflection and evaluation of our reactive grant disbursement. Our proposal focuses on a comprehensive assessment of this process, intending to transition from a passive model of merely funding inbound applications via a Grant Program to a more proactive model of consciously allocating capital and initiating strategic projects in a holistic manner.

Alastor and w3s bring a wealth of strategic acumen to the table. Alastor recently guided the strategic merger between mStable and dHedge. This collaboration exemplified our ability to identify and unlock synergies between different projects, ensuring shared value creation. Meanwhile, w3s is leading Gro DAO’s Strategy Pod leading discussions with ecosystem stakeholders and supporting a wide range of crypto companies in strategic thinking (e.g., Zerion).

Together Alastor and w3s are currently leading the Uniswap Working Group Zero setting up the grant program for its Arbitrum Airdrop. Our combined network permeates the crypto market with communication channels established with most ecosystem players, DeFi protocols, and relevant early-stage companies.

This enables us to broker valuable conversations and partnerships (find track record examples on our websites here and here). Coupled with our strategy backgrounds honed at some of the world’s leading institutions such as McKinsey, Qatalyst, and Blackstone, we are well-equipped in strategy formulation and execution.

The Opportunity

As the decentralized lending industry grows, there is an opportunity for Compound to leverage its strong brand recognition and Compound III’s potential. To regain market share and drive innovation, focused effort, strategy, and coordination among motivated contributors are required.

2022 was a tailwind for the decentralized lending industry. The collapse of several centralized entities in crypto should be a long-term tailwind for our industry. As the industry recovers, the opportunity for permissionless, decentralized protocols to continue to grow is obvious.

Compound’s brand value remains strong. Compound is a pioneering protocol with strong brand recognition. Compound is not starting from ground zero, far from it. It’s easy to get excited about the protocol’s potential with a concerted strategy and deliberate effort.

Compound III offers the chance at a reset. Compound III’s minimalist and efficiency-based approach has the potential for it to be a new primitive in DeFi. Still, it comes with its own set of tradeoffs and we do not believe it is widely understood by developers and market participants. With the proper attention, engagement, and support, each Compound III instance can optimize for different use cases & risk levels, allowing a customizable approach to borrow/lend that the market hasn’t yet seen.

The growth of the specialized Compound III cWETH market has demonstrated that such an approach can succeed. All of that said, Compound III still has very limited adoption. Growing the protocol and realizing its potential requires focused effort, strategy, and coordination among a motivated set of contributors.

This window of opportunity is shrinking. If we revisit the points above: Compound’s usage has been & is being gradually eroded away by Aave, who shipped capital-efficiency improvements faster and has executed better on the business development front. As a result, Compound’s brand & community have suffered — Compound is no longer at the forefront of conversations. This has caused active and potential protocol contributors and partners to go elsewhere in search of greater opportunities.

Alastor and web3 Studios are ready to step in to help revitalize the Compound Protocol.

From Opportunity to Outcomes

As we set out to transform this opportunity into a tangible reality, our vision focuses on revitalizing Compound’s role as an innovator in the DeFi ecosystem by assembling a top-tier, team from Alastor and web3 Studios with strategic, governance, and financial expertise.

We aim to pinpoint the largest ROI development and growth needs of the protocol and set up the strategic pillars to build and onboard new users and contributors to Compound III.

Below are the items we propose prioritizing along the key workstreams in Strategy & Growth. This list is not exhaustive and is flexible based on Compound community feedback. We want to be open to both (a) new opportunities that may arise and (b) ideas from engaged community members.

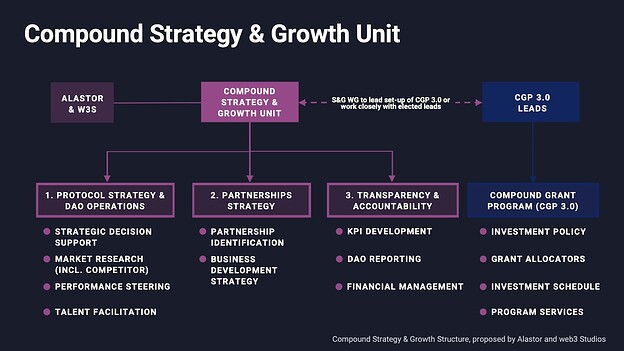

Strategy and Growth Unit

To achieve this, it’s critical to follow a clear North Star Goal to serve as a guiding principle, aligning all our efforts:

Following this, we will focus on three main areas:1. Steer Protocol Strategy & DAO Operations

Take broad responsibility for Compound’s strategic direction

- Strategic Decision Support: Inform protocol decision-making from a strategic and financial lens to support development priorities and general protocol growth.

→ i.e., analyze the highest ROI assets to whitelist on v3 & assess ROI of different cross-chain initiatives. - Market Research: Conduct market research to identify emerging trends, opportunities, and potential threats, and identify future product development.

→ i.e., analyze up-and-coming protocols and what differentiators Compound can learn from and replicate. - Competitive Analysis: Assess and analyze competitor strategies, strengths, weaknesses, and product development to help Compound maintain a competitive edge

→ i.e., analyze initiatives of leading competitors to drive TVL and user growth? - Performance Steering: Implement a robust system for tracking and monitoring key performance indicators, enabling data-driven decision-making and continuous improvement within the DAO

→ i.e., use KPIs to enable strategic decision-making - Talent Facilitation: When necessary, facilitate the recruitment and onboarding of additional key contributors, providing support and guidance to keep development and growth efforts aligned and cohesive

→ i.e., when a specific initiative has been identified as a high ROI use of grant funds, determine the right team to execute. (We believe the most effective grant programs in DeFi should be proactively bringing in talent rather than simply putting up RFPs and hoping the right teams come through)

2. Develop Partnerships Strategy

Set up a partnership strategy to drive deposits and borrower growth

- Partnership Identification: Identify the highest ROI channel partners to acquire new Compound users and drive protocol growth

- Examples include: non-custodial wallets, digital asset managers, crypto exchanges, neobanks, and other DeFi protocols (among others).

- Examples of some of the work required to identify high-ROI partnerships: user and asset analysis, regulatory research, and user and potential partner interviews.

- Business Development Strategy:

- Develop a comprehensive business development approach, focusing on unique growth channels, relationship management, market positioning, and alignment with Compound’s overall goals and values.

- Utilize strategic planning, industry insights, and targeted engagement to maximize ROI.

3. Set up Transparency and Accountability Standards

Establish a lightweight reporting framework to ensure transparency and accountability of progress without adding unnecessary bureaucracy to the DAO

- KPI Development: Outline and identify KPIs required for strategic decision-making and build out the infrastructure to transparently track and communicate these to DAO stakeholders

- DAO Reporting: Create reports to the DAO on performance (incl. protocol usage, treasury, etc.) and progress of initiatives across the contributor base

- Financial Management: Establish financial processes such as:

- Budgets

- User Statistics & Fees

- Operating Expenditures

4. Facilitate Compound Grant Program 3.0 (CGP 3.0)

Acknowledgment: Consideration of Existing Efforts and Collaboration for CGP 3.0

Recognizing Questbook’s valuable contributions to CGP, we are open to various paths forward, always prioritizing Compound’s best interests.

We are mindful of the considerable work effort put forth by Questbook over the last term as they structure CGP 3.0. Their dedication and the learnings gathered are greatly appreciated. Moving forward, we offer two potential paths:

- Assuming Responsibility (If Needed): Should the community decide against Questbook’s proposal, we are prepared to take over, crafting a best-in-class Grant Program. Leveraging our experience in Venture Capital and extensive research on top-tier DeFi Grant Programs for Uniswap, we have the insight and expertise to guide CGP 3.0 to success.

- Collaboration with Questbook (If Desired): If the community collectively believes Questbook should continue their work, we stand ready to collaborate closely. Our goal would be to ensure CGP 3.0 integrates seamlessly into a holistic Strategy & Growth Plan for Compound, benefitting from both organizations’ strengths.

As mentioned above, our overarching vision is to transition from a passive model of merely funding inbound applications via a Grant Program to a more proactive, conscious capital allocation. By initiating strategic projects in a holistic manner, we aim to serve Compound’s best interests. Whether leading or supporting, our commitment to Compound’s growth remains steadfast, and we are eager to play the role that best serves the community’s needs.

In case the community should decide against Questbook and we assume responsibility, here’s our preliminary plan for guiding the development and success of CGP 3.0.

Establish Grant Program Compound Grant Program 3.0 (CGP 3.0)

Create a multifaceted Grant Program to cultivate the Compound ecosystem, aligning with strategic goals and long-term growth opportunities.

- Investment Policy Definition: Outline clear financial objectives, risk tolerance, and target investments within the Arbitrum-Uniswap ecosystem.

- Grant Allocator Team: Set up a dedicated group of experts for allocating Grants through leading due diligence and taking investment decisions.

- Investment Schedule Creation: Define a timeline for deploying funds, detailing key milestones for initial disbursement and follow-on investments.

- Program and Service Implementation:

- Mentoring and Advisory Services: Offer guidance in areas such as strategy, customer acquisition, retention, engagement, go-to-market, and fundraising

- Research Initiatives: Allocate resources to explore new use cases or address technical challenges

- Cross-community Grants: Aim at community builders for adjacent contributions, such as educational content, engagement, and promotion.

Economics

Developing a comprehensive strategy for growth requires specialized expertise and significant time commitment. The roles are clearly defined, with a Senior Strategy Resource expected to dedicate roughly 20 hours a week to guide the overall execution, and a Team Resource estimated at 20 hours a week to execute and drive specific opportunities. This pricing reflects the scenario where the work does not encompass establishing a Grant Program but instead collaborates with existing parties to integrate it into a holistic Strategy and Growth initiative.

Given the variations in these time commitments, based on the complexity and needs of the strategic goals, we propose the following compensation plan that reflects the critical responsibilities of each role:

| Role | Per Hour Cost | Hours Dedicated Per Week | Total |

|---|---|---|---|

| Senior Strategy Resource | $100 | 20 | $48,000 |

| Team Resource | $80 | 20 | $38,400 |

| Operations Cost, Misc. | $2,000 | ||

| Total Amount Required | $88,400 |

Alastor and w3s hope that this can be a long-term engagement between our team and Compound. We aim to deliver work such that the Compound community will be excited to continue to work with us beyond just this first proposal.

Who is Alastor and web3 Studios?

Our team combines the expertise of Alastor and web3 Studios (“w3s”), bringing together top-tier experience from work in web3 (Uniswap, Zerion, Polygon, Lido, Gitcoin, and others), TradFi (Qatalyst, Blackstone), Consulting (McKinsey), and collectively creating an extensive web3 network. The combined groups significant experience in traditional business & financial services combined with its crypto-native focus makes it uniquely qualified to advise Compound at this critical juncture.

Alastor is a crypto-native strategic and financial advisory firm for Web3 based out of New York. Its founders, Jordan Stastny and Sam Bronstein, were previously strategic advisors at Qatalyst where they advised leading technology companies on M&A and strategy.

The Alastor team prepared a report for Uniswap on fee switch ramifications and recommendations and served as advisor to mStable on their sale to dHEDGE. The Alastor team has also done strategic grant work for Lido, Decentraland, and Gitcoin.

web3 Studios is an strategic advisory firm exclusively focused on companies building the open economy based. Founded by Blackstone and McKinsey alumni, the group facilitates M&A, capital raising, and strategic projects for web3 companies and DAOs.

The group is part of the Uniswap Working Group Zero setting up the grant program for its Arbitrum Airdrop, has previously been engaged with Zerion, doing Strategic and Governance Work for Gro DAO, and conducted research work together with leading web3 firms such as Polygon, The Sandbox, and DappRadar.

What’s Next

We invite community members to pa the discussion and share their feedback below. Direct messages are open, and we welcome one-on-one sessions to explore more detailed or complex topics.