Simple Summary

The Compound DAO is at a crossroads, facing critical decisions on its future direction. Recent debates in the community have centered on three main paths: (1) granting Alpha Growth significant control over the protocol’s strategy, (2) fostering collaboration with Morpho to remain competitive in DeFi lending, or (3) restructuring DAO operations to establish clearer leadership and governance.

Each of these options presents trade-offs in how the protocol evolves and how governance is structured. The DAO must now align on a path forward to maintain its competitiveness in a rapidly shifting market. This post aims to break down the key choices and their implications, opening the discussion for the community to determine the best course of action.

Background

I’m sharing this perspective as an independent delegate. For over three years, I served as Compound’s Protocol Security Advisor on OpenZeppelin’s behalf until I left the company in December 2024. I remain engaged with the Compound community through the CGP Security Tooling Domain but have largely stayed out of recent forum discussions. However, multiple community members have recently asked me to weigh in as tensions have escalated.

The current debates revolve around the Alpha Growth Renewal, the Morpho <> Polygon Collaboration, and broader discussions on DAO operations and protocol improvements. These conversations span multiple forum threads, highlighting a growing sense of frustration:

- [AlphaGrowth] 2025 Compound Growth Program V3

- [AlphaGrowth] Growth Program Organizational Structure

- Compound <> Morpho <> Polygon Collaboration

- Dao Ops Concerns

- Temperature Check: Compound v4

- Compound Sandbox: Development Proposal

Ultimately, all these discussions boil down to a fundamental question: How does Compound remain competitive, and what role should the DAO play in achieving that?

The Three Paths Before Us

My proposal here is to cut through the noise and boil all the competing visions into three clear paths that the DAO should decide on. They are:

- Alpha Growth Direction - Centralizing leadership under Alpha Growth

- Morpho Collaboration - Aligning with Morpho to remain competitive.

- DAO Operationalization - Establishing a structured governance model for Compound’s future.

1. Alpha Growth Direction

The latest 2025 Compound Growth Program Proposal would grant Alpha Growth dominant influence over Compound for the next year. The proposal allocates $7 million in COMP for salaries, security, grants, incentives, and other areas beyond their original growth mandate.

Alpha Growth has undeniably contributed to Compound’s growth over the past year, but this proposal effectively places them in control of the protocol’s direction. It also creates potential friction with existing vendors such as OpenZeppelin and CGP by overlapping responsibilities. With this proposal, Alpha Growth will effectively be driving all major decisions, whether explicitly mandated or not.

While I personally disagree with the cost and structure of this current proposal, I acknowledge the clear benefits of having a single organization own protocol leadership. If Alpha Growth is to take on this role, the proposal should explicitly state this and outline how existing DAO vendors and programs will be integrated under their leadership.

2. Morpho Collaboration

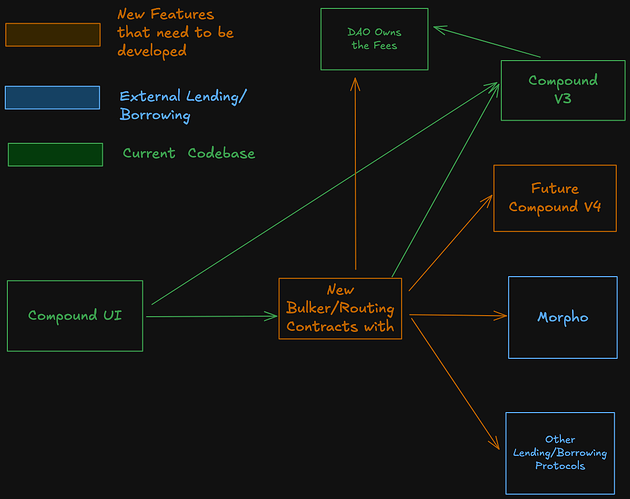

The recently passed Morpho <> Polygon <> Compound collaboration proposal lays the groundwork for a long-term partnership between Compound and Morpho, rather than direct competition. Facilitated by Gauntlet, this initiative has the DAO deploying and managing Morpho Vaults on Polygon, filling the gap left by Aave’s departure from the network. Compound will receive all revenue generated, with the potential for Gauntlet to receive fees later through a DAO-approved split.

The implication of this proposal is clear: Morpho is more competitive than Compound V3 Comet Markets. Morpho markets have outperformed Compound in attracting TVL since launch. The curator model enables faster asset listings, risk parameter adjustments, and better incentive alignment than Compound’s DAO-managed risk approach.

By aligning with Morpho, Compound would shift towards leveraging its brand, treasury, and TVL to deploy more Morpho vaults over time. This would position Compound and Morpho to compete directly with Aave rather than each other.

While the Morpho <> Polygon proposal has passed, the DAO still has the choice to fully commit to this strategy or instead focus on maintaining and improving the existing Compound protocol. Does the DAO prioritize value accrual through the best available lending protocol (even if it’s not Compound) or invest in further development of Compound’s existing infrastructure?

3. DAO Operationalization

The third path is recognizing the DAO’s leadership gap and filling it with a structured operational team. Since Compound Labs stepped back from actively guiding the protocol after launching Compound V3, leadership has been fragmented and ad-hoc. DAO contributors, including myself, have attempted to fill the void, but the lack of structure remains a challenge.

If the DAO does not pursue the first two paths—ceding direction to Alpha Growth or aligning with Morpho—it must build an internal leadership structure to remain competitive. A core team must be established to own the protocol’s development and manage DAO vendor relationships.

This path would likely involve launching a Compound V4 to address Comet’s shortcomings. A high-level discussion has already begun, but executing a new version will require operational leadership. WOOF, a current protocol contributor team, is already working on Compound Sandbox, offering more permissionless functionality, but I believe it falls short of the overhaul needed to compete with Aave and Morpho.

This is the most complex path, requiring sustained involvement from community contributors and delegates. However, if the DAO is unwilling to consolidate under Alpha Growth or shift to Morpho, it must commit to structuring internal leadership to drive long-term success.

Where do we go from here?

The next few months will be crucial in determining Compound’s future. The DAO must choose a clear direction to remain competitive in DeFi lending. The decision comes down to:

- Centralizing leadership under Alpha Growth,

- Partnering with a growing lending protocol like Morpho, or

- Building an internal structure to lead the protocol’s future.

Other paths may emerge, but these three represent the most viable options that I see as available to the DAO today.

On a personal note, Compound has been a major part of my life, and I’ve had the privilege of working with many in this community. As the first major lending protocol and one of the pioneers of DAO governance, Compound has always been a trailblazer. Now, it must once again confront systemic challenges head-on and make difficult decisions to ensure its future longevity.

I leave it to the community to debate and decide. My hope is that by framing these choices clearly, we can have a productive discussion about the best way forward. Whatever path is chosen, it should be inclusive, transparent, and reflective of the community’s shared vision.