The proposal outlines three high-level solutions to address rate stability. In this analysis, we evaluate the primary goals articulated in the proposal and assess the feasibility of the proposed mechanisms. Our focus will be on interest rate dynamics (e.g., utilization, borrow rate) rather than COMP-specific utility considerations.

Utilization Rate & Borrow Rate Stability

Under Compound’s kink-based interest rate model, when utilization exceeds the “kink” point, the borrow rate increases at a significantly steeper slope compared to utilization below the kink. This can lead to high borrow rate volatility during periods of high utilization, even with minor fluctuations in utilization.

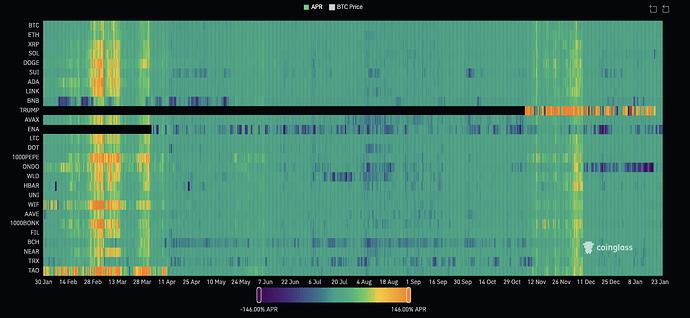

To stabilize rates, it’s important to distinguish between persistent (structural) and transient high utilization. Persistent high utilization often indicates strong borrower demand for leverage during bull markets, and traders accept higher funding rates to maintain leveraged positions. This dynamic was evident in Q1 and November-December 2024, where rising borrow rates coincided with sustained high utilization.

Source: DefiLlama USDC(Compound V3 - Ethereum)

Source: Coinglass Perps Funding Rate Heatmap

Several solutions can address rate volatility due to the structurally persistent high utilization:

- Increase the rate at kink (

borrowPerSecondInterestRateSlopeLowandsupplyPerSecondInterestRateSlopeLow) or raise the kink (borrowKinkandsupplyKink) - Increase the incentive for supplying the base asset or reallocate the incentive from borrowing to supplying the base asset

However, these adjustments do not completely eliminate rate volatility—they merely reduce its magnitude. Overly aggressive kink rates risk lowering the pool’s capital efficiency (e.g., underutilized liquidity) and reducing protocol revenues, so this is a delicate balancing act.

Reducing Borrow Incentives to 0% Post Kink

Gauntlet’s recent interest rate change proposal recommends a post-kink slope of 1.26 for ETH and 3.4 for USDC. This means that a 1% increase in utilization above the kink would increase the annual borrow rate by 1.26% for ETH and 3.4% for USDC. By comparison, the current borrow incentive are 0.39% for the ETH market and 0.41% for the USDC market. To contextualize the relative impact: reducing post-kink borrow incentives has a similar impact to a 0.1-0.3% utilization fluctuation under the proposed curve.

Additional factors, such as borrower responsiveness (elasticity of demand), further influence outcomes and warrant deeper analysis. While we agree with the direction of reducing post-kink borrow incentives, the actual effect remains uncertain due to these variables. We encourage readers to interpret the data with these nuances in mind.

Governance Bottleneck

As evidenced by the December 7’s Gauntlet Interest Rate Proposal, which is just passed, the pace of governance is not ideal for responding to rapidly shifting market dynamics. To address this, we propose two options for adjusting incentives:

- Bypass Governance Voting with Guardrails

- Delegate limited permissions to the service provider for incentive adjustments within predefined bounds (e.g., ±20% COMP emissions). This approach retains human oversight to account for complex factors such as borrower demand elasticity, while bypassing full governance cycles for urgent changes.

- Programmatic Incentive Adjustments

- Automate incentive adjustments using a kink-based model that mirrors Compound’s existing interest rate curve. Under this system, incentives would dynamically rebalance between borrowing and supplying based on utilization: more incentive for borrowing when utilization is low (to stimulate demand) and for supplying when utilization climbs (to stabilize liquidity). This avoids sudden incentive cuts and organically aligns incentives with market conditions. However, parameterizing such a model requires deeper research into borrower elasticity (e.g., how demand responds to rate hikes) to avoid unintended consequences.

Cross-Chain Rate Disparities

Rate disparities naturally exist across chains and protocols, even when the lending pools share similar configurations. While building Compound-owned vaults to automate cross-chain arbitrage is conceptually appealing and could enhance user experience, existing arbitrageurs likely haven’t capitalized on these opportunities due to:

- Inventory Risk: Unlike atomic liquidations where liquidators face minimal inventory risk, rate arbitrageurs take on inventory risk because the transaction executions are not atomic.

- Inadequate Profit Margins: After accounting for borrowing fees, gas costs, bridging fees, and development overhead, arbitrage can yield negligible or negative returns.

- Transient Opportunities: profitable opportunities may disappear and the spreads may narrow before the positions are settled.

Before building the vaults, we should assess whether arbitrageurs are absent due to structural unprofitability or other operational hurdles. We recommend:

- Conduct a quantitative analysis to model historical rate gaps against execution costs.

- Piloting a minimum viable arbitrage vault to test feasibility if the development costs are manageable.

- Publishing a transparency dashboard that tracks profit/loss metrics to validate assumptions.

Key Takeaways

Adjusting the interest rate curve stands out as the most effective solution to stabilize borrow rates, which is being addressed in Gauntlet’s proposal. By increasing the pre-kink slope, rates will rise faster as utilization rises, preemptively discouraging excessive borrowing before utilization reaches volatile post-kink levels. To potentially increase the impact further, pair curve adjustments with incentive adjustments to incentivize certain behaviors. Cross-chain arbitrage vaults, while promising, their development costs must be validated against potential protocol benefits and execution risk.