TLDR:

Utilization Rates are too high, and ETH Borrowers on Mainnet are withdrawing their capital to pursue better rates.

- Depositors are looking to unwind positions as they are losing token.

Borrow costs are too high for their strategies to be profitable, and Competitors are offering borrow rates of 2.72%.

Here are three high level solutions:

- Programmatically Adjusted Incentives. Reduce Incentives for Borrows above kink utilization rate.

- List COMP as collateral on every market.

- Build Compound Owned Vaults which facilitate automated cross-chain, interest rate arbitrage.

Implementing these strategies will benefit both COMP holders, and provide rate stabilization for markets.

1. Reduce Borrow Incentives

Compound is currently spending $45,000 in daily issuance to incentivize borrowing and lending.

We have high utilization rates across the board, and need systemic solutions to challenge this problem. The first step is reducing Borrow Incentives to 0% when markets are above kink utilization.

We are overpaying to incentivize Borrowers.

AlphaGrowth has nearly 1M in OP incentives, ready to distribute to strategically incentivize TVL on Optimism – and we will end up spending most of it on Supply because utilization is too high to do anything else.

The speed at which governance can respond is not fast enough to keep up with the market, and as we head into the bull market, incentivizing the borrow side makes no sense.

Our objective ought to be to increase market capacity, while retaining 85% or higher utilization, so we can minimize emissions, and stabilize borrow rates.

2. COMP as Collateral on Every Market.

COMP Everywhere was proposed a couple weeks ago on the Forums:

- Source: COMP Everywhere

Given our need to create an equilibrium of rates across market arbitrage opportunities, COMP Everywhere has become a more pressing solution.

When COMP is listed as collateral on every market and chain – COMP holders will be able to gain yield by helping to stabilize rate inefficiencies in Compound Markets.

WOOF is building a Position Migrator which helps users find better rates, and migrates their positions to secure those rates. PALOMA previously built Multichain Migration Bots to utilize USDC across four chains for Compound. Compound Multichain Migration Bots for ETH & USDC Markets on ETH, BASE, ARBITRUM

AlphaGrowth is looking to expand this Position Migrator and Multichain Migration Bots to create a vault for Automated Cross-Chain Interest Rate Arbitrage.

COMP holders can supply COMP as collateral into an Arbitrage Vault, and help close the delta between markets on different chains. The high level flow is as follows:

- Event occurs where a significant interest rate difference between a Lend and Borrow Rate on base asset markets such as USDC or ETH is available.

- COMP will be supplied on the lower rate market and borrow the base asset(USDC,ETH) on chain A.

- Vault will then bridge base asset(USDC,ETH) to chain B

- Vault on chain B will lend base asset(USDC,ETH) into higher rate market

- Listener will monitor rates until Arbitrage is no available and will kick off unwind scenario.

- Upon flat or negative rate the vault will calculate and communicate unwind the lend of the base asset(USDC,ETH) on chain b.

- Vault will bridge base asset(USDC,ETH) back to chain a.

- Vault will repay the borrow on chain a.

The results are:

- Automated Cross-Chain Arbitrage Opportunities for COMP holders.

- Cross-Chain Market Equilibrium.

3. Automated Cross-Chain Interest Rate Arbitrage

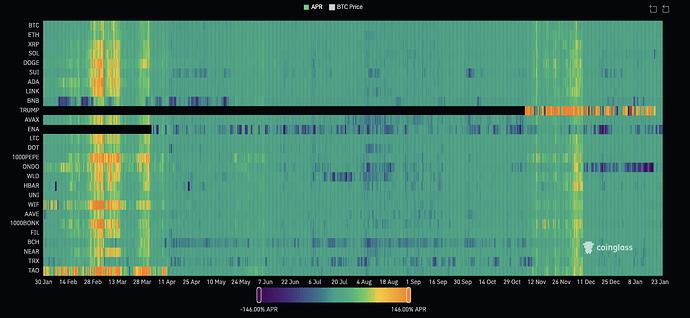

The modified dashboard below shows an example of these market inefficiencies at work:

.

While the example above only uses Optimism and Mainnet - we can implement these cross chain vaults on all markets. New Chain Deployments will benefit in demand and Yield, and Mainnet Markets will have their supply needs balanced.

The objective is to lower utilization until it backs off of the Kink, while providing an easy way for COMP holders to help discover utilization equilibrium across chains.

We can include this strategy on all current, and upcoming deployments.

Interest Rate Arbitrage as Structured Products:

These vaults are structured to focus on accumulation – meaning success is defined by accumulating more of the deposited asset.

We are calling this style of Vault “X on Y”, meaning Y is deposited, and the user is earning X on their deposit at some APR.

- COMP on COMP

- USDC on COMP

- USDT on COMP

- ETH on COMP

COMP on COMP is the most interesting, because we are pulling yield out of inefficiencies in Compound Markets, and giving it to COMP holders, while improving the market rates for everybody else.

You can think of this entire mechanism as a Stability Module, coupled with native yield for COMP.

Summary

When an opportunity is available within Compound Protocol, COMP holders ought to benefit from, and be involved in that solution.

The following are systemic design choices which open up a better way to run the protocol:

- Lower Borrow Incentives to 0% when Market Utilization is above 85%.

- List COMP as Collateral on Every Market.

- Build and Launch a series of Automated Cross-Chain Interest Rate Arbitrage Vaults.

Our belief is that these are steps which lead toward more utility for COMP, and more efficient markets.