Compound V2: Risk Parameter Updates 2023-1-10

Simple Summary

Gauntlet proposes no changes to Compound V2 parameters this week.

We note that our simulations recommend increasing CF for USDC from 85.5% to 87.5%, which has relatively limited market downturn risk and also limited price manipulation attack risk, given borrow caps for tail assets are in place. However, we do not recommend this right now, given the community’s prioritization for migration. Should the community still prefer to implement this capital efficiency improvement on V2, we would look forward to that feedback.

Abstract

Gauntlet’s simulation engine has ingested the latest market and liquidity data. These parameter updates are a continuation of Gauntlet’s regular parameter recommendations as part of Dynamic Risk Parameters.

Motivation

This set of parameter updates seeks to maintain the overall risk tolerance of the protocol while making risk trade-offs between specific assets. Gauntlet has published a blog post on our parameter recommendation methodology to provide more context to the community.

Our parameter recommendations are driven by an optimization function that balances 3 core metrics: insolvencies, liquidations, and borrow usage. Our parameter recommendations seek to optimize for this objective function. Gauntlet’s agent-based simulations use a wide array of varied input data that changes on a daily basis (including but not limited to user positions, asset volatility, asset correlation, asset collateral usage, DEX/CEX liquidity, trading volume, expected market impact of trades, liquidator behavior). Our simulations tease out complex relationships between these inputs that cannot be simply expressed as heuristics. As such, the charts and tables shown below may help understand why some of the parameter recommendations have been made but should not be taken as the only reason for recommendation. Our individual collateral pages on the dashboard cover other key statistics and outputs from our simulations that can help with understanding other interesting inputs and results related to our simulations.

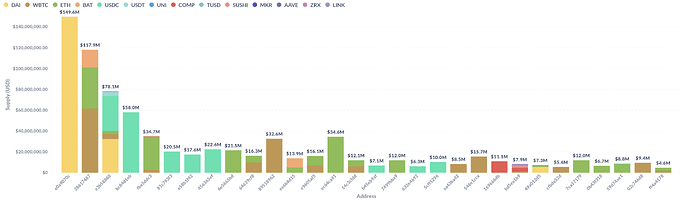

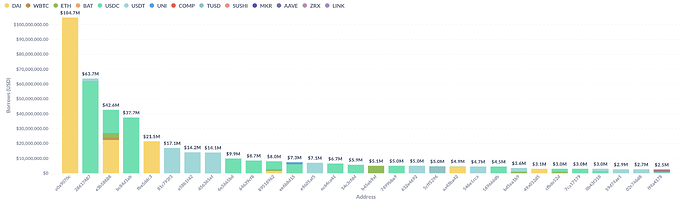

Top 30 borrowers’ aggregate positions & borrow usages

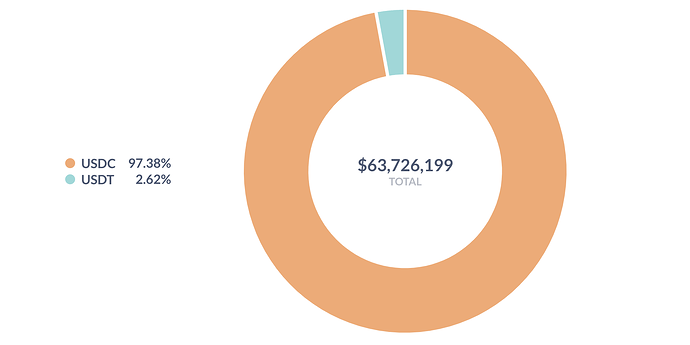

Top 30 borrowers’ entire supply

Top 30 borrowers’ entire borrows

Price changes of key assets since 2022-12-21

Users at Risk Analysis

User 1: 0xe84a061897afc2e7ff5fb7e3686717c528617487

This user continues to account for the vast majority of LaR, indicating that the position is likely to be safely liquidated by the market.

Below are details of the user’s position:

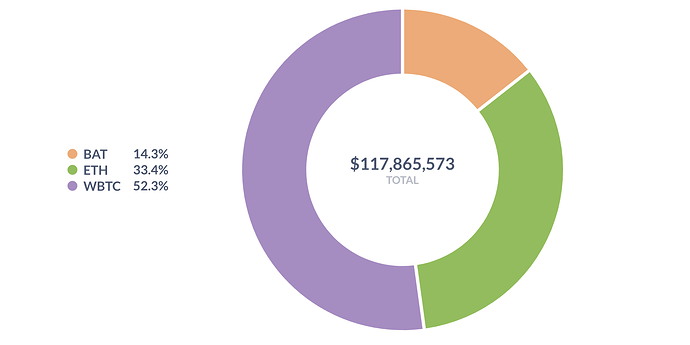

User supply breakdown

Relevant collateral factors

User borrowing power breakdown

User borrows breakdown

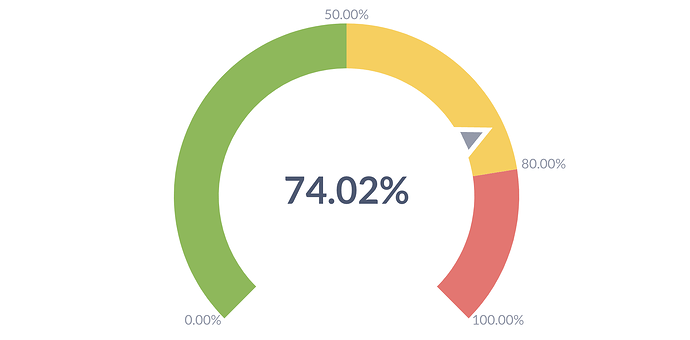

User borrow usage

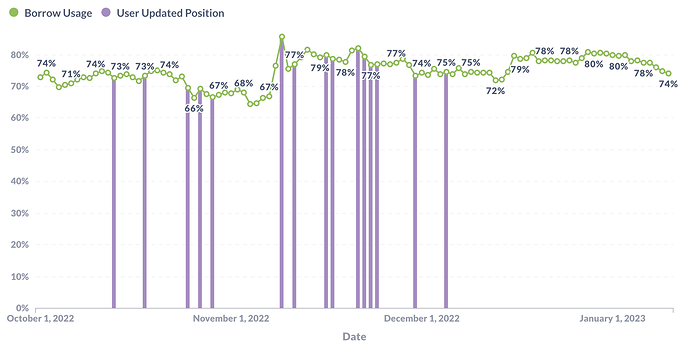

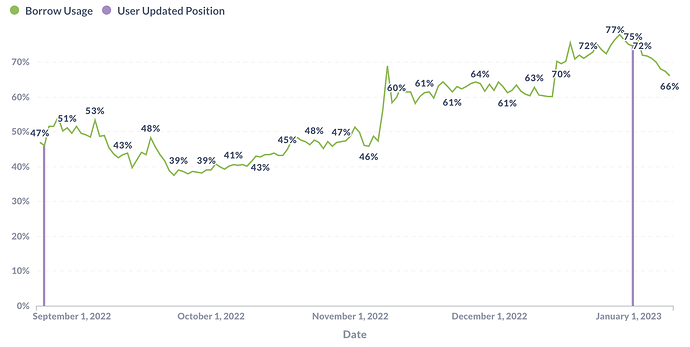

Below is a time series of borrow usage for this user, with the purple bars corresponding to dates when the user actively updated the tokens in their position. From this, we can observe the user’s “intended” borrow usage.

User borrow usage time series since 2022-10-01

User 2: 0xd74f186194ab9219fafac5c2fe4b3270169666db

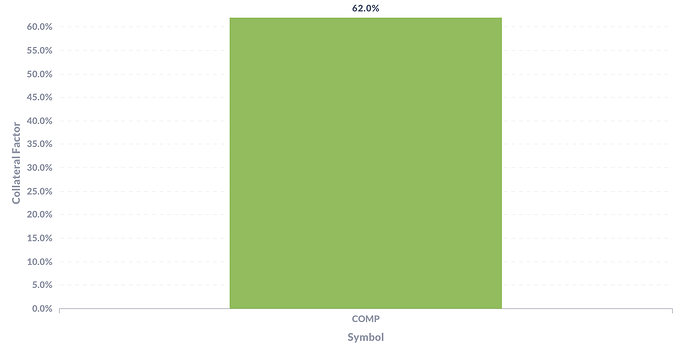

Gauntlet’s most recent Compound v2 proposal was executed on January 2 and decreased COMP CF from 65% to 62%.

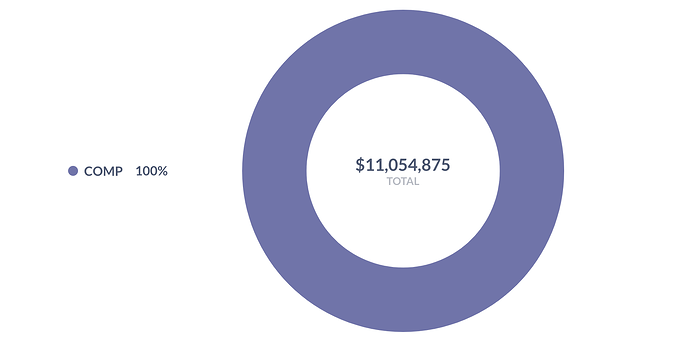

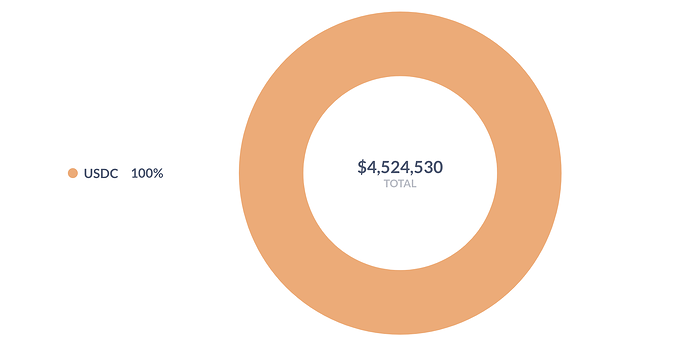

Before our last post, this user accounted for 71% of the total COMP supply in the protocol and a significant amount of COMP VaR. The user had previously last updated their position on August 26, 2022. On January 2, 2023 (the day of the proposal execution), this user updated their position to decrease their COMP supply from $14.9M to $9.8M and decreased their USDC borrows accordingly from $7.25M to $4.53M to maintain the same 75% borrow usage, thereby reducing risk to the protocol. COMP price has since increased, thereby increasing this user’s total COMP dollar supply and decreasing borrow usage.

Below are details of the user’s position:

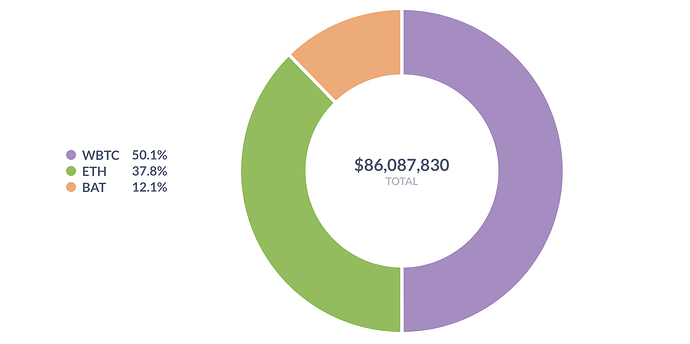

User supply breakdown

Relevant collateral factors

User borrowing power breakdown

User borrows breakdown

User token supply time series

User token borrows time series

User borrow usage

User borrow usage time series since 2022-08-25

Dashboard

The community should use Gauntlet’s Risk Dashboard to understand better the updated parameter suggestions and general market risk in Compound.

When making recommendations, Gauntlet takes into account the entire distribution of insolvencies and liquidations from our simulations and weighs them against increases in borrows. The below metrics give the community insight into some of the insolvency and liquidation tail risks the protocol could face and Capital Efficiency improvements the protocol stands to gain. Click the collateral-specific pages linked in the Collateral Risk section for more detailed simulation metrics.

Value at Risk represents the 95th percentile insolvency value that occurs from simulations we run over a range of volatilities to approximate a tail event.

Liquidations at Risk represents the 95th percentile liquidation volume that occurs from simulations we run over a range of volatilities to approximate a tail event.