Simple Summary

Should the community choose to list WETH, weETH, USDC, and USDT on the Mainnet wstETH Comet, Gauntlet recommends the following risk parameters:

Risk Parameters

| Comet | Collateral | Supply Cap | Collateral Factor (CF) | Liquidation Factor (LF) | Liquidation Penalty (LP) |

|---|---|---|---|---|---|

| Mainnet wstETH | WETH | 100,000 | 90% | 93% | 4% |

| Mainnet wstETH | weETH | 10,000 | 90% | 93% | 4% |

| Mainnet wstETH | USDC | 10,000,000 | 80% | 83% | 10% |

| Mainnet wstETH | USDT | 15,000,000 | 80% | 83% | 10% |

DEX Liquidity

Note: Additional liquidity can come from Lido’s wstETH/stETH redemption mechanism. Also, the below are a summary of the largest liquidity channels and are not exhaustive.

WETH

| Pool Type | Pool Name | Pool URL | TVL ($) | 24H Volume ($) |

|---|---|---|---|---|

| Uniswap V3 | wsETH / WETH | wstETH/WETH - Wrapped liquid staked Ether 2.0 Price on Uniswap V3 with 0.01% Fee | GeckoTerminal | 15.1M | 9.6M |

| Balancer V2 | wstETH / wstETH - WETH - BPT / WETH | wstETH/WETH - Wrapped liquid staked Ether 2.0 Price on Balancer V2 (Ethereum) with 0.01% Fee | GeckoTerminal | 29.5M | 2.2M |

| Fluid | wstETH / ETH | Fluid | 140.15M | 9.0M |

Total TVL: $184.75MM

weETH

| Pool Type | Pool Name | Pool URL | TVL ($) | 24H Volume ($) |

|---|---|---|---|---|

| Uniswap V3 | weETH / WETH 0.01% | weETH/WETH - Wrapped eETH Price on Uniswap V3 with 0.01% Fee | GeckoTerminal | 30.90M | 37.84K |

| Curve | weETH / WETH | weETH/WETH - Wrapped eETH Price on Curve | GeckoTerminal | 23.65M | 5.7M |

| Balancer | RZR / weETH 1% | RZR/weETH - Rezerve.money Price on Balancer V3 (Ethereum) with 1% Fee | GeckoTerminal | 2.39M | 1.76K |

| Curve | tETH / weETH | tETH/weETH - Treehouse ETH Price on Curve | GeckoTerminal | 897.82K | 207.09K |

Total TVL: $57.84MM

Slippage

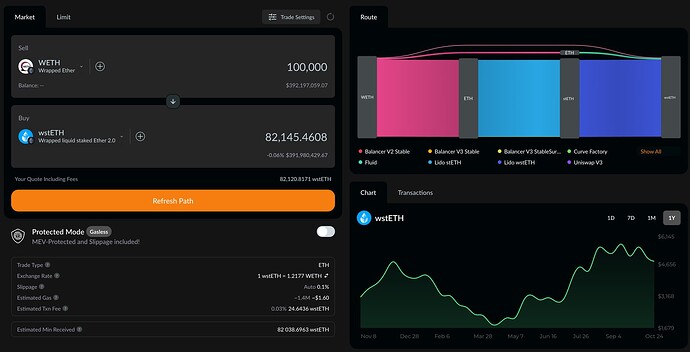

WETH

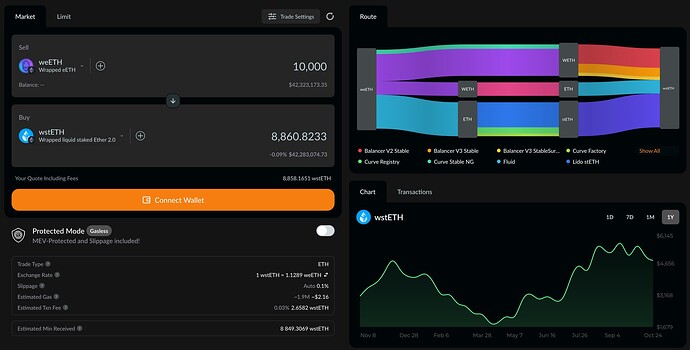

weETH

USDC

USDT

Analysis

Supply Caps

Given the observed slippage, Gauntlet recommends the supply caps for WETH and weETH at 100,000 and 10,000 respectively. Liquidating the total supply caps would incur slippage under 1%, which is well below the 4% liquidation penalty. For USDC and USDT, we suggest 10,000,000 caps for each. These would see roughly 1% slippage. However, this is still much lower than the 10% liquidation penalty that we set.

CF/LF/LP

Gauntlet recommends aligning the CF, LF, and LP for WETH and weETH on the wstETH Comet to align with other correlated ETH derivative collaterals. The parameters for USDC and USDT are set more conservatively in-line with other stablecoin collaterals given the lack of correlation to wstETH.

Next Steps

- We welcome community feedback.