This is an updated, shortened version of the proposal, as we’re no longer able to edit the initial post.

TL;DR

This proposal aims to activate some of Compound’s idle treasury assets to improve capital efficiency and boost revenue, complementing Gauntlet’s reserve management with growth-focused strategies to support the protocol’s growth initiatives and long-term sustainability. The strategy has two parts:

- COMP Yield Strategy with option to sell at opportunistic strikes: Use COMP to generate USDC whilst allowing sales if prices exceed pre-defined strike prices. This strategy maintains COMP exposure whilst making opportunistic sales possible at higher prices. In the meantime, it generates somewhere between 15%-35% annualised net USDC-denominated yield on COMP tokens.

- USDC Yield Strategy: USDC earned on the COMP strategy will be deposited into a Compound-exclusive DeFi Yield vault, which is a diversified strategy that tends to generate between 8-18% APY depending on market conditions.

Outcomes:

- Earning a USDC-denominated yield on COMP (minimum 15%).

- Build USDC buffer from COMP strategy that earns additional yield; use to finance, for example, the Delegate Compensation Program, conduct COMP buybacks if price falls below $50, and/or support other growth-related initiatives.

Ask:

- 100k COMP ($5m as of March 8th) to run COMP strategies to generate USDC for the treasury.

- Generated USDC to be deposited into the Compound DeFi Yield Vault on Enzyme to earn yield (which will follow a similar strategy as the Avantgarde DeFi Yield Fund but permissionlessly); to be earmarked for Delegate Program, COMP buybacks and/or other growth-initiatives.

Proposal

This proposal seeks to set up a growth-oriented treasury strategy to complement the management of reserves by Gauntlet, with the aim of improving capital efficiency and revenue generation on treasury assets to support the DAO’s capacity to fund further growth initiatives and strengthen financial sustainability. The proposed strategy includes two core parts:

1. COMP Yield Strategy + Limit Sell Order Option

We will begin by implementing a strategy to earn USDC yield on COMP tokens which can be used to fund other initiatives, buyback COMP, or grow the treasury without sacrificing long-term token exposure. The strategy aims to effectively monetize COMP’s appreciation potential while maintaining a source of stable revenue; allowing the treasury to generate revenue by agreeing to sell COMP tokens only if a set “strike” price is reached within a specific timeframe (aka “duration”). Regardless of whether the sale occurs, the treasury earns a premium, creating a consistent source of income while maintaining control of the tokens until the set strike price is met.

Below we include an example to show how the strategy basically works. This example is purely for educational purposes, and the cited duration and strike parameters, as well as the yield and earnings are purely hypothetical and on the conservative end. Actual durations and strike targets will be adjusted dynamically to achieve the highest yield within good risk parameters.

We will target a minimum 15% yield net of fees per annum (p.a.), but believe we can achieve upwards to 30% in the current market. Indicative quotes for the premium and APY can be simulated at MYSO Finance.

Example:

COMP price at time of execution = $72.46 per COMP

Strike prices:

- 34.5K COMP at 94.20 (half the allocated COMP at 130% strike)

- 34.5K COMP at 108.69 (half the allocated COMP at 150% strike)

Estimated annualized gross premium (received upfront):

- Minimum 15% p.a. (projected $750k p.a. on $5M notional)

Duration: 180 days (for example)

Possible Outcomes:

- COMP > strike

- DAO earns an estimated $375k upfront ($750k p.a.)

- If COMP is sold at the 30% strike price of 94.20:

- Total proceeds = 34,500 COMP x 94.20 = $3,251,700 USDC

- Initial cost (based on baseline price) = 34,500 COMP x 72.46 = $2,499,870

- Gain from sale = $3,251,700 - $2,499,870 = $751,830 (excluding premiums)

- If COMP is sold at the 50% strike price of 108.69:

- Total proceeds = 34,500 COMP x 108.69 = $3,748,805 USDC

- Initial cost (based on baseline price) = 34,500 COMP x 72.46 = $2,499,870

- Gain from sale = $3,748,805 - $2,499,870 = $1,248,935 (excluding premiums)

- If all COMP are sold:

- Total gain from sales (+ premium): $1,248,935 + $751,830 = $2,000,765 ($2,375,765)

- The USDC is then deposited into the DeFi Yield Vault.

- Avantgarde makes a new proposal to the DAO to top up the strategy (at much higher levels).

- If COMP is sold at the 30% strike price of 94.20:

- COMP < strike

- DAO has earned an estimated $375k in 6 months ($750k p.a.)

- COMP has not been sold.

- Strategy repeated to bring in another $375k for the next 6 months.

This pattern repeats.

Note: Myso takes a 15% fee on premiums (not sales) generated, which includes a referral fee.

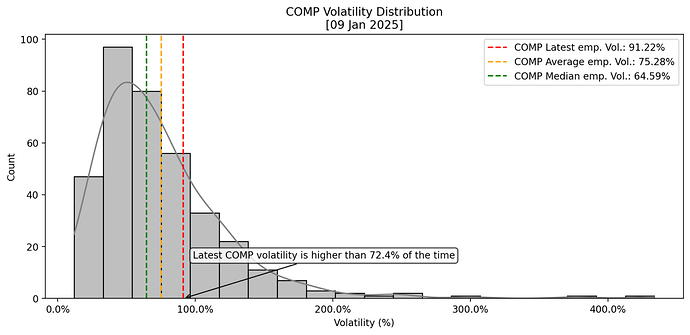

Note: option premium and yields may fluctuate as they depend on COMP’s current price volatility, where the higher the volatility the higher the option premiums one can generate. The above indicative premiums are calculated as of 9 January 2024 where COMP had a slightly above average realized short-term volatility of 91% p.a.

COMP Yield Operations

Execution of this strategy will be done through the MYSO v3 protocol, which eliminates the need for institutional trading firms to take custody of COMP tokens or rely on off-chain legal agreements. The entire process is decentralized, secure, and transparent, ensuring maximum returns while retaining full asset control for the COMP treasury.

When a loan is successfully matched with a trading firm, the underlying COMP coins are locked in a segregated timelock escrow smart contract (audit report: Omniscia Audit Report). Upon match, the counterparty must automatically pay the premium to initiate the start. If the limit price is reached at maturity of the loan, the trading firm should pay the agreed strike price; otherwise, the coins automatically unlock after expiry, returning to the COMP treasury, eliminating counterparty risk.

In summary, the COMP treasury can efficiently operationalize on-chain strategies using MYSO v3 as follows:

- On-chain settlement without counterparty risk: COMP are locked on-chain through segregated escrow smart contracts, removing the need for trust in trading firms.

- Competitive bidding through Dutch auctions: transparent auctions ensure the highest possible premiums.

- Advanced treasury control: the COMP treasury can control when coins enter circulation (if the option is in-the-money) and retain voting power if needed.

2. USDC Deployment

There are two potential sources of USDC to be generated from the COMP yield strategy: first the guaranteed up-front premium, then the potential sale in case the COMP price is above the respective strike prices at expiry.

We propose to deposit the USDC generated from the strategy into a Compound DeFi Yield Vault on Enzyme, which is a diversified, conservative-risk stablecoin strategy currently generating 15% APY (realistic average 8-15%) as an alternative to the reserves managed on Aera.

As it grows in size over time, this vault could be used to buy back COMP when market momentum and conditions are less favourable, or finance various growth-related initiatives. For now, the strategy will generate a guaranteed USDC premium and allow the treasury to lock in profits at higher prices for a rainy day, should the market continue to trend higher.

Compound DeFi Yield Vault

A Compound-exclusive, non-custodial and permissioned vault to access on-chain yields within DeFi, focusing on the largest, most battle-tested protocols.

- Realistic average expectations 8-15% APY.

- Aims to be diversified across stablecoins, protocols, and underlying yield sources.

- Balances the level of yield with risk and capacity.

- Actively managed.

- 0.5% protocol fee and 7.5% performance fee; calculated and paid out automatically by the vault.

- Reporting is on-chain provable and auditable 24/7 via the Enzyme UI, and Avantgarde will provide additional formal reporting on the performance of assets on a quarterly basis, and can respond to interim questions as the community deems appropriate.

- The DAO can withdraw from the vault at any time. Please note that the vault may hold positions that accrue rewards on third party protocols which ideally should be claimed prior to a withdrawal. Hence, while the DAO could withdraw instantly and receive its deposit in the tokens held in the vault, the optimal way would be for the DAO to communicate its desire to withdraw in advance to facilitate liquidity management within the vault and ensure a seamless withdrawal process.

- Avantgarde Finance acts as the delegated manager with certain smart contract roles & permissions (ensuring that Avantgarde can not misappropriate the funds).

- Any changes made to the vault won’t go into effect until after a 7-day cooldown period (please note that there is no reason to expect any such changes, and if there were, Avantgarde will make sure to communicate those on the forum with at least two weeks’ notice).

Reporting

- Quarterly Reports: Detailed written reports on the strategies performance and results.

- Community Call Updates: Monthly updates to the Compound community.

Key Outcomes of the Proposal

- Earn c 15-35% annualised net USDC-denominated yield on COMP.

- Earn yield on the generated USDC, currently 15% (realistic avg. 9-15%).

- Only diversify into market strength, not weakness.

- Mitigate market impact on COMP by limiting capacity and strategy implementation.

- Build a USDC buffer earmarked for the Delegate Compensation Program, other growth-related initiatives, and/or consider buybacks if COMP falls below, say, $50.

Fee Summary

- COMP Yield Strategy: 15% on premium only.

- DeFi Yield Vault: 0.5% protocol fee and 7.5% performance fee.