Gauntlet is recommending canceling Proposal 291 since market conditions have improved and risks associated with large liquidations have subsided. We will still recommend fully deprecating the COMP v2 market but are recommending setting more conservative parameters for the v3 comets on which COMP is listed

Ethereum v2

- Decrease COMP Collateral Factor from 15% to 0%

- Decrease the COMP Borrow Cap to 1

- Pause COMP Borrows on Comp

Ethereum USDC Comet

- Decrease COMP Collateral Factor from 65% to 50%

- Decrease COMP Supply Cap from 900,000 to 100,000

Ethereum USDT Comet

- Decrease COMP Collateral Factor from 65% to 50%

Analysis

Gauntlet has run simulations on the current outlying positions within the USDT and USDC Comet. We are observing relative risk within the USDT Comet. Simulations indicate a possible $100K shortfall in the event of a 35% drop, assuming conservative slippage based on current DEX liquidity.

This increased risk is due to two positions, including 0x6e57181d6b4b7c, which opened their debt position in the past 36 hours. The user’s intent is unclear, but their recent large position, which had a low health factor during the COMP market price drop and ongoing uncertainty, suggests that caution is warranted when listing COMP as a collateral asset.

As a further measure, we recommend lowering the collateral factor to 50% to require larger buffers and a minimal health factor of 1.40 to open a COMP position for both USDC and USDT Comets moving forward.

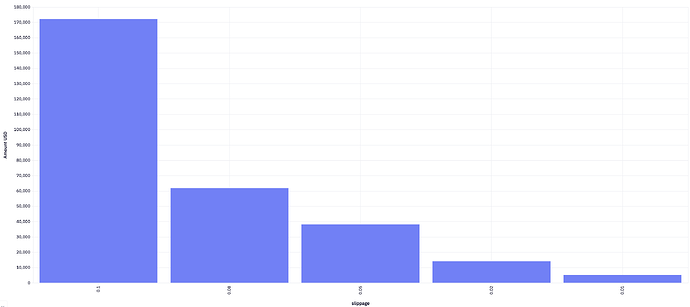

USDC Comet is in a relatively safer position, with a 35% drawdown not causing any insolvencies to the protocol. However, Gauntlet would recommend lowering the supply cap to reduce any further growth in the supply of COMP until we have seen greater on-chain liquidity. As shown below, DEX liquidity will need to become more robust in the event of further collateralization of COMP positions. At this time, most of the liquidity is available within CEXes where there is currently $4.3M in 2% market depth.

COMP Slippage Relative to DEX Liquidity

COMP DEX Liquidity Pools on Mainnet

| Dex Category | Pool address | TVL(mil) |

|---|---|---|

| uniswap_v3 | 0xea4ba4ce14fdd287f380b55419b1c5b6c3f22ab6 | 1.77 |

| uniswap_v3 | 0x5598931bfbb43eec686fa4b5b92b5152ebadc2f6 | 1.70 |

| balancer_ethereum | 0x344818b9b4cfec947fe8ccbea65b3605585c2c71 | 1.49 |

| sushiswap | 0x31503dcb60119a812fee820bb7042752019f2355 | 0.84 |

| uniswap_v3 | 0xceee866d0893ea3c0cc7d1be290d53f8b8fe2596 | 0.66 |

| uniswap_v2 | 0xcffdded873554f362ac02f8fb1f02e5ada10516f | 0.21 |

| defi_swap | 0x59f7a66a2fbcaf203cee71359b51142238f85b78 | 0.11 |

| balancer_ethereum | 0xefaa1604e82e1b3af8430b90192c1b9e8197e377 | 0.01 |

| sakeswap | 0xc134922a5d9117dbb97904b61fcbe04b803b5c50 | 0.01 |

Next Steps

- Welcome feedback from community