Gauntlet would like to inform the community of recent growth in the Ethereum USDC comet.

Simple Summary

- USDC supplies and borrows are both at all-time highs for the comet.

- USDC supply has increased from $160M to $387M (+141%) in the past month.

- USDC borrows have increased from $156M to $363M (+132%) in the past month.

- The comet lost ~$60k USDC reserves over the past month, which is minimal compared to ~$1M/month in COMP rewards the comet distributes to incentivize growth.

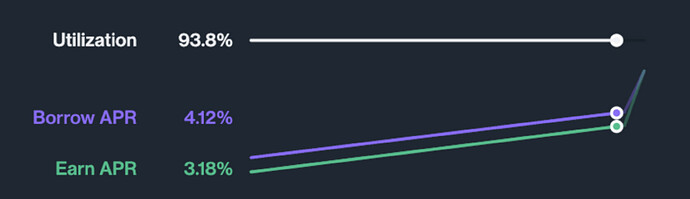

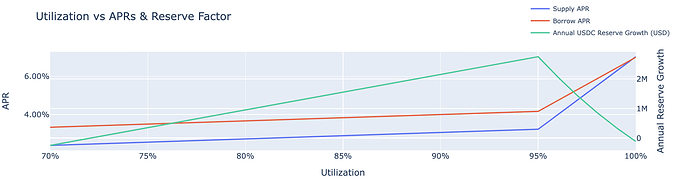

- The borrow kink in the IR Curve has been re-established at 95% (implied 20% reserve factor), and as a result, the protocol will not experience negative reserve growth at high utilizations.

Analysis

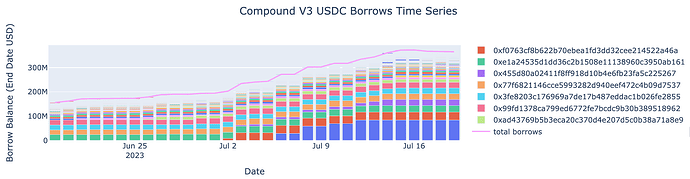

USDC Supply and Borrows for Compound Ethereum v3 USDC are at all-time highs currently, with supply at $387M and borrows at $363M. Below are time series charts of the collateral, USDC borrows, and USDC supply over the past month.

In the past month, USDC supply has increased from $160M to $387M (+141%), and USDC borrows have increased from $156M to $363M (+132%).

Time Series of USDC Reserve Growth

As seen above, in the past month the comet has lost ~$60k USDC reserves, since reserve growth under the previous IR curve was negative during periods of high utilization. However, the protocol experienced tremendous TVL growth, and the $60k reserve losses are minimal compared to ~$1M/month in COMP rewards the comet distributes to incentivize growth.

The new IR curve reintroduces the borrow kink at 95% (implied 20% reserve factor), ensures reserve growth will be positive even at high utilizations, and is on pace to earn greater reserves with higher TVL.