Simple Summary

Gauntlet recommends the following risk recommendations to the protocol:

Risk Parameters

| Status | Comet | Asset | Collateral Factor (CF) | Liquidation Factor (LF) | Liquidation Penalty (LP) |

|---|---|---|---|---|---|

| Current | Unichain USDC | UNI | 68% | 74% | 17% |

| Proposed | Unichain USDC | UNI | 65% | 70% | 22% |

Rationale

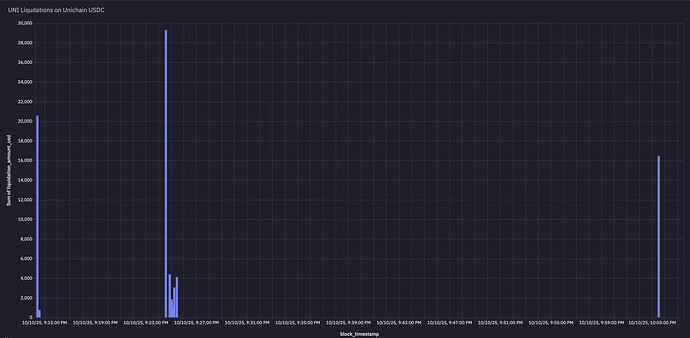

- During the recent market downturn on October 10, 2025, Gauntlet observed significant UNI liquidations on the Unichain USDC comet (see below):

- To mitigate future risk, Gauntlet recommends adjusting the CF, LF, and LP. These updates will trigger liquidations earlier and allow liquidators to process them more efficiently.

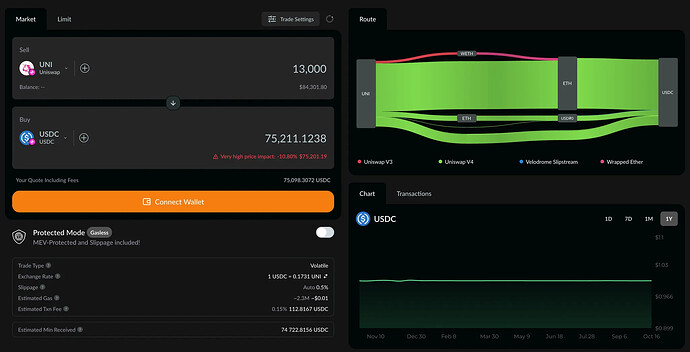

- In the plot above, roughly 13,000 UNI were liquidated in a four-minute window between 9:23 PM and 9:27 PM. At current market conditions, this would incur over 10% slippage. Gauntlet notes that during the downturn, slippage would likely be higher.

- Gauntlet recommends increasing the Liquidation Penalty (LP) to 22% to encourage liquidators to process liquidations more efficiently. To further reduce potential risk and enhance the likelihood of timely liquidations, Gauntlet also suggests lowering the Collateral Factor (CF) to 65% and the Liquidation Factor (LF) to 70%.

Next Steps

- We welcome community feedback.