Simple Summary

Gauntlet recommends the following adjustments to the protocol:

Risk Parameters

| Status | Comet | Collateral | Collateral Factor (CF) | Liquidation Factor (LF) | Liquidation Penalty (LP) |

|---|---|---|---|---|---|

| Current | Mainnet USDC | cbBTC | 80% | 85% | 5% |

| Proposed | Mainnet USDC | cbBTC | 80% | 85% | 10% |

| Current | Mainnet USDC | COMP | 50% | 75% | 25% |

| Proposed | Mainnet USDC | COMP | 60% | 75% | 20% |

| Current | Mainnet USDC | wstETH | 80% | 85% | 10% |

| Proposed | Mainnet USDC | wstETH | 82% | 86% | 9% |

| Current | Mainnet USDT | wstETH | 80% | 85% | 10% |

| Proposed | Mainnet USDT | wstETH | 82% | 86% | 9% |

| Current | Mainnet USDT | COMP | 50% | 75% | 25% |

| Proposed | Mainnet USDT | COMP | 60% | 75% | 20% |

Supply Caps

| Status | Comet | Collateral | Supply |

|---|---|---|---|

| Current | Mainnet USDC | COMP | 100,000 |

| Proposed | Mainnet USDC | COMP | 125,000 |

| Current | Mainnet USDT | cbBTC | 1,000 |

| Proposed | Mainnet USDT | cbBTC | 500 |

| Current | Mainnet USDT | COMP | 100,000 |

| Proposed | Mainnet USDT | COMP | 125,000 |

| Current | Mainnet USDT | UNI | 1,300,000 |

| Proposed | Mainnet USDT | UNI | 975,000 |

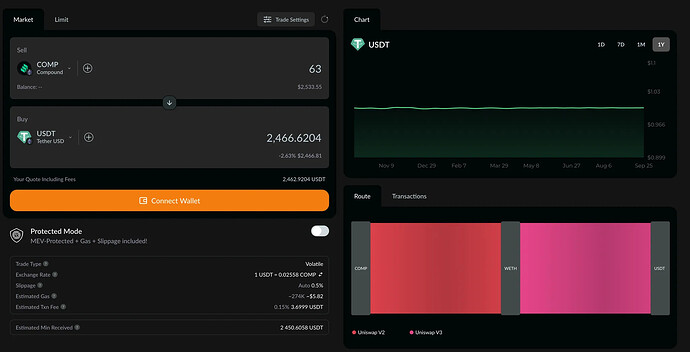

DEX Liquidity

| Pool Type | Pool Name | Pool URL | TVL ($) | 24H Volume ($) |

|---|---|---|---|---|

| uniswap_v3 | COMP / WETH 0.3% | COMP/WETH - Compound Price on Uniswap V3 with 0.3% Fee | GeckoTerminal | 2,516,058.41 | 15,717.83 |

| uniswap_v3 | COMP / WETH 1% | COMP/WETH - Compound Price on Uniswap V3 with 1% Fee | GeckoTerminal | 2,603,272.41 | 3,727.46 |

| uniswap_v2 | COMP / WETH | COMP/WETH - Compound Price on Uniswap V2 | GeckoTerminal | 182,676.41 | 32,254.17 |

| sushiswap | COMP / WETH | COMP/WETH - Compound Price on SushiSwap | GeckoTerminal | 150,092.23 | 22,624.04 |

Total TVL: $5.45M

Compound’s trading volume across markets exceeds $42M daily. COMP tokens are primarily traded on centralized exchanges (CEXs) rather than on-chain decentralized exchanges (DEXs). These CEXs use market makers to support trades, maintain order book liquidity, and offer users alternative ways to access COMP liquidity.

Slippage

USDC

The above slippage reflects the projected average liquidation amount (across both comets) after the proposed cap changes. The rationale for this value is described the Supply Caps section of analysis.

USDT

The above slippage reflects the projected average liquidation amount(across both comets) after the proposed cap changes. The rationale for this value is described the Supply Caps section of analysis.

Analysis

Supply Caps

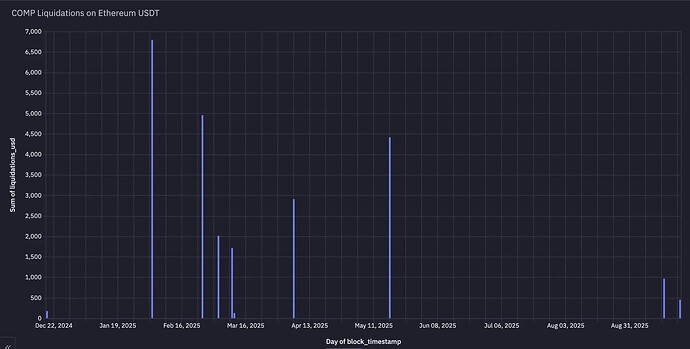

COMP

Gauntlet has been monitoring high supply cap usage for COMP on the Mainnet USDT and USDC comets over recent months. Over the past year, there have been fewer than $40,000 worth of liquidations for COMP across both of these comets.

Overall, we observed ~20 liquidation events over the past year, with an average liquidation amount of ~$2,000. With a 25% cap increase, this would come to $2,500. Noting the simulated slippage results, sufficient DEX liquidity absorbs the cap increase. Gauntlet recommends adjusting the supply caps mentioned above, also noting that COMP has no bad debt. We will monitor user demand over the coming months and propose further adjustments accordingly.

cbBTC & UNI:

The outlined markets have demonstrated low user demand over the past 30 days, with maximum supply cap utilization consistently staying below 35%. We recommend lowering the supply caps for these markets to reduce risk exposure to the protocol. Gauntlet notes that cap reductions will not affect currently open positions.

CF/LF/LP

Gauntlet recommends setting the Liquidation Penalty (LP) for cbBTC to 10% in the Ethereum USDC/USDT Comets to align the market with other Bitcoin market parameters.

Gauntlet also recommends increasing the COMP Collateral Factor (CF) to 60% for the Ethereum USDC/USDT Comets. This recommendation aligns with the supply cap adjustment rationale, as data shows minimal liquidations and no bad debt for COMP. We propose reducing the LP to 20% to create an appropriate buffer between CF and LF. Gauntlet notes that COMP’s annual log volatility stands at 88.2%, which is significantly lower than comparable tokens.

Additionally, we recommend increasing the Collateral Factor (CF) for wstETH to 82% in the Ethereum USDC/USDT Comets. This adjustment aims to stimulate market growth and attract more users to the protocol. We also recommend adjusting the LF to 86% to provide an appropriate buffer between CF and LF.

Next Steps

- We welcome community feedback.