Simple Summary

If the community wishes to proceed with listing USDC and USDT as collateral on the Mainnet WETH and WBTC comets, Gauntlet recommends the following risk parameters:

Risk Parameters

| Comet |

Collateral |

Supply Cap |

Collateral Factor (CF) |

Liquidation Factor (LF) |

Liquidation Penalty (LP) |

| Mainnet WETH |

USDC |

20M |

83% |

88% |

7% |

| Mainnet WETH |

USDT |

20M |

83% |

88% |

7% |

| Mainnet WBTC |

USDC |

10M |

80% |

85% |

10% |

| Mainnet WBTC |

USDT |

10M |

80% |

85% |

10% |

Slippage

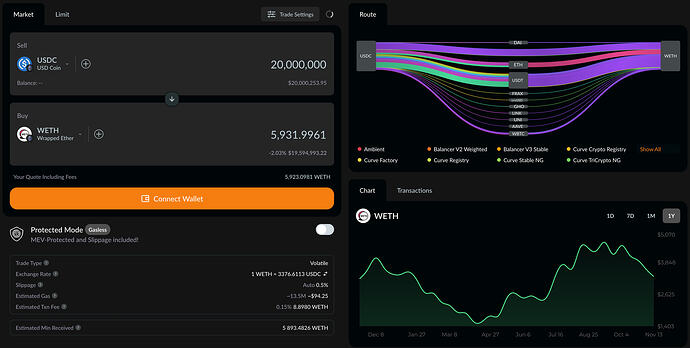

Mainnet WETH

USDC

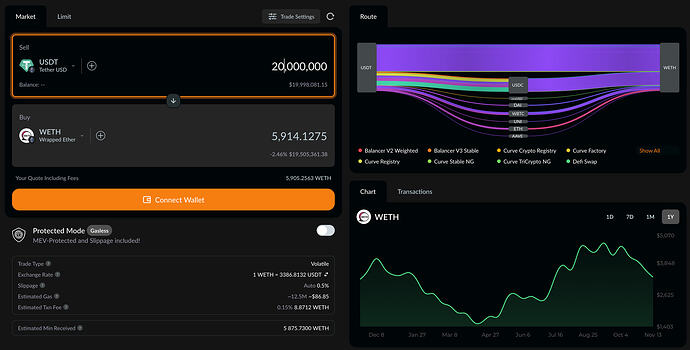

USDT

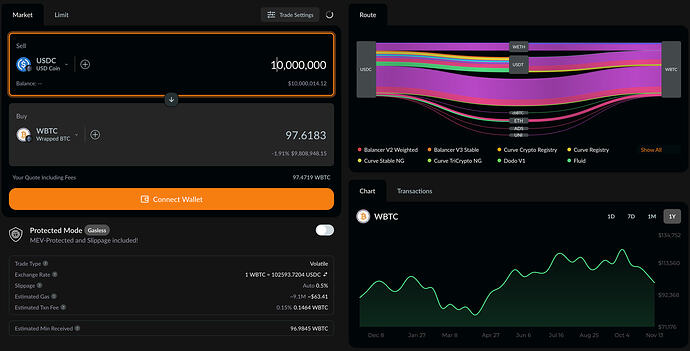

Mainnet WBTC

USDC

USDT

Analysis

Supply Caps

Given the above slippage results, Gauntlet recommends setting supply caps on Mainnet WETH to 20M for both USDC and USDT. The ~2% slippage on both swaps falls well below the 7% liquidation penalty, ensuring sufficient incentive for liquidators.

Similarly, Gauntlet recommends setting supply caps on Mainnet WBTC to 10M for both USDC and USDT. The ~2% slippage on both swaps falls well below the 10% liquidation penalty.

CF/LF/LP

Mainnet WETH

Gauntlet recommends aligning CF, LF, and LP with those for WETH collateral on the Mainnet USDC and USDT comets.

Mainnet WBTC

Gauntlet recommends aligning CF, LF, and LP with those for WBTC collateral on the Mainnet USDC and USDT comets.

Next Steps

We welcome community feedback.

1 Like

Add USDC and USDT to the WETH market on Mainnet

PR - Add USDC and USDT to WETH market on Mainnet by MishaShWoof · Pull Request #1057 · compound-finance/comet · GitHub

PR(woof) - Add USDC and USDT to WETH market on Mainnet by MishaShWoof · Pull Request #254 · woof-software/comet · GitHub

Proposal - Tally | Compound | Add USDC and USDT as collaterals into cWETHv3 on Mainnet

Recommendations

The recommendations provided by Gauntlet

| № |

Name |

USDC |

| 1 |

SupplyCap |

50M(e6) |

| 2 |

USDC token Decimals |

6 |

| 3 |

USDC token Address |

0xA0b86991c6218b36c1d19D4a2e9Eb0cE3606eB48 |

| 4 |

Collateral Factor |

80% |

| 5 |

Liquidation Factor |

85% |

| 6 |

Liquidation Penalty |

5% |

| № |

Name |

USDT |

| 1 |

SupplyCap |

50M(e6) |

| 2 |

USDT token Decimals |

6 |

| 3 |

USDT token Address |

0xdAC17F958D2ee523a2206206994597C13D831ec7 |

| 4 |

Collateral Factor |

80% |

| 5 |

Liquidation Factor |

85% |

| 6 |

Liquidation Penalty |

5% |

Actions

| № |

Action name |

Link |

Status |

| 1 |

Run Slither |

Link |

Success |

| 2 |

Run Forge Tests |

Link |

Success |

| 3 |

Run Tests With Gas Profiler |

Link |

Success |

| 4 |

Run Semgremp |

Link |

Success |

| 5 |

Run Scenarios (mainnet-weth) |

Link |

Success |

| 6 |

Run Unit Tests |

Link |

Success |

| 7 |

Run ESLint |

Link |

Success |

| 8 |

Run Contact Linter |

Link |

Success |

| 9 |

Run Prepare |

Link |

Success |

| 10 |

Run Enact impersonate |

Link |

Success |

| 11 |

Tenderly simulation (mainnet) |

Link |

Success |

| 12 |

Run Enact (by delegator) |

Link |

Success |

Artifacts

| № |

Name |

Value |

| 1 |

Migration name |

1762179749_add_usdc_and_usdt_collateral |

| 2 |

Branch name |

woof-software/add-usdc-and-usdt-to-mainnet-weth |

| 3 |

Prepare id |

19431679451 |

| 4 |

Network |

mainnet |

| 5 |

Deployment |

weth |

Description

Add USDC and USDT as collaterals into cWETHv3 on Mainnet

Proposal summary

WOOF proposes to add USDC and USDT into cWETHv3 on Ethereum network. This proposal takes the governance steps recommended and necessary to update a Compound III WETH market on Ethereum. Simulations have confirmed the market’s readiness, as much as possible, using the Comet scenario suite. The new parameters include setting the risk parameters based on the recommendations from Gauntlet.

Further detailed information can be found on the corresponding proposal pull request and forum discussion.

Proposal Actions

The first action adds USDC asset as collateral with corresponding configurations.

The second action adds USDT asset as collateral with corresponding configurations.

The third action upgrades Comet to a new version.