[Chainrisk] - Sonic Comet Recommendations

Addressing the concerns of @YJN21 and the sonic team, we at Chainrisk, herein present the updated parameter recommendations for Compound Sonic Comet.

Collateral Asset Selection

Proposed Market Details

“Note :- All data referenced in this draft has been sourced from records dated February 27, 2025.”

Proposed Markets by Sonic Team:

| Markets |

Collaterals |

| USDC.e |

SONIC, stS, solvBTC |

| USDT.e |

SONIC, stS, solvBTC |

| SONIC |

stS |

Market Selection Summary:

We propose the deployment of the following Comets and their corresponding collateral listings on Sonic.

-

USDC.e Market

- Recommended Collaterals:

- Not Recommended Collateral:

- solvBTC: We do not recommend adding solvBTC at this time due to their insufficient on-chain DEX liquidity. However, solvBTC may be considered for future inclusion if additional tokens are bridged and liquidity in the DEX improves.

-

USDT.e Market

- Recommended Collaterals:

- Not Recommended Collateral:

- solvBTC: We do not recommend adding solvBTC at this time due to their insufficient on-chain DEX liquidity. However, solvBTC may be considered for future inclusion if additional tokens are bridged and liquidity in the DEX improves.

-

Sonic Market

Recommended Comet and Assets for Listing:

| Comet |

Collateral Assets |

| USDC.e |

Sonic, stS |

| USDT.e |

Sonic, stS |

| SONIC |

stS |

Risk Parameter Recommendation

Abstract

Here, we discuss the parameter recommendations for the proposed SONIC, USDT.e and USDC.e Comets. Chainrisk supports the listing of SONIC, and stS as collaterals in USDC.e and USDT.e Comets, and stS as collateral in SONIC comet.

USDC.e Comet

| Asset |

Collateral Factor (%) |

Liquidation Factor (%) |

Liquidation Penalty (%) |

Supply Cap |

| SONIC |

76 |

81 |

15 |

8,000,000 |

| stS |

76 |

81 |

15 |

7,500,000 |

USDT.e Comet

| Asset |

Collateral Factor (%) |

Liquidation Factor (%) |

Liquidation Penalty (%) |

Supply Cap |

| SONIC |

76 |

81 |

15 |

4,000,000 |

| stS |

76 |

81 |

15 |

3,800,000 |

SONIC Comet

| Asset |

Collateral Factor (%) |

Liquidation Factor (%) |

Liquidation Penalty (%) |

Supply Cap |

| stS |

88 |

93 |

5 |

20,000,000 |

Detailed Analysis

Volatility Analysis:

We have used the aggressive method to estimate potential downside risks in log returns by analyzing specific percentile values. This approach assumes that future returns will follow a similar probability distribution as historical returns, allowing us to assess the extent to which prices might drop under adverse conditions.

The percentile values have been standardized using a scaling factor to annualize the log returns. These values represent the potential maximum drop in returns with a (1-p) probability exceeding the p^{th} percentile value, meaning that actual future negative returns are likely to remain within these thresholds with (1-p) probability.

Analysis of Stablecoin Comets

In this case, we calculate percentile values of change in log returns of prices with respect to the stablecoins (USDC.e / USDT.e ). This allows us to assess how much each collateral asset might decline relative to the base asset.

Historical Price Performance :

Log Return Analysis:

Percentile Values in log price changes for Collateral Assets:

| Percentile |

stS (%) |

SONIC (%) |

| 10th |

-2.70 |

-2.71 |

| 15th |

-2.19 |

-2.19 |

| 20th |

-1.80 |

-1.81 |

| 25th |

-1.51 |

-1.52 |

Interpretation:

- SONIC :

- The 20th percentile value of -1.81% means that in 80% of historical observations, the log returns of price drop (over a 6-hour period) did not fall beyond -1.81%. Moreover, with a probability of 0.8, we can say that the expected future price drop will not exceed 1.81%.

- The risk of large negative returns decreases as we move up the percentiles, reaching only -0.59% at the 35th percentile.

- stS :

- Since stS is staked asset of SONIC being analyzed in its original form, its percentile values closely match stS.

Key Takeaways from USD-Based Analysis:

- SONIC experiences the potential downside risk, with values between -6.07% (maximum log price decrease/drawdown) and -0.29% (40th percentile annualized log price change).

- ‘stS’ follows a similar pattern to ‘S’, indicating that these two assets exhibit comparable volatility trends in USD terms.

Analysis of SONIC Comet

In this case, we calculate stS prices with respect to SONIC. The rationale behind this transformation is to evaluate risk from a relative perspective—how these assets behave when SONIC is the reference point instead of stablecoins.

*stS / Sonic Price :

Log Return Analysis:

Percentile Values in log price changes for Collateral Asset:

| Percentile |

stS (%) |

| 10th |

0.00132 |

| 15th |

0.00135 |

| 20th |

0.00138 |

| 25th |

0.00139 |

Interpretation:

- stS:

- The values remain positive across all percentiles, suggesting that stS does not exhibit a significant risk of negative returns when expressed relative to SONIC.

- This implies that SONIC and stS move in near alignment, making stS relatively stable with respect to SONIC.

Conclusion on Volatility Analysis :

This log price return percentiles analysis provides valuable insights into the relative volatility and downside risks of stS and SONIC for the above comets.

- If stablecoins are the base asset, then stS and SONIC have nearly comparable risk exposure.

- If SONIC is the base asset, stS exhibits little to no downside risk.

These findings underscore the importance of selecting an appropriate base asset when assessing risk, as the choice of reference point significantly influences the interpretation of volatility and downside potential.

On-Chain Asset Analysis:

SONIC(S) is the native token of the Sonic Chain. Other collateral assets are bridged to the Sonic chain primarily from other chains. These bridged assets represent the total token supply available within the Sonic ecosystem. Approximately $694 million in assets are bridged from the other chains.

Data Source: https://defillama.com/chain/Sonic?chainAssets=true&tvl=false

FDV:

| Asset |

Value (in $) |

| S |

~$209M |

| stS |

~$87M |

| USDC.e |

~$129M |

| USDT.e |

~$10M |

| solvBTC |

N/A |

Analysis of Liquidity of DEX Pairs:

USDC.e Comet:

-

For wS/USDC.e

-

For stS/USDC.e

USDT.e Comet:

There is currently limited liquidity for USDT.e with SONIC or stS tokens. However, USDT.e can be efficiently swapped into USDC.e, which can then be converted into other assets like Sonic or stS. Currently, USDT.e/USDC.e Pair has aggregate liquidity pools for around $15M+.

Sonic Comet:

stS / wS Pairs:

Slippage Analysis:

We observe that the current slippage for each collateral asset on the DEX is significantly lower than the set Liquidation Penalty (LP). This minimizes the risk of extreme slippage scenarios. Chainrisk recommends a supply cap and LP, as detailed in the table below.

USDC.e Comet:

| Asset |

Liquidation Penalty (%) |

Supply Cap |

| SONIC |

15 |

8,000,000 |

| stSONIC |

15 |

7,500,000 |

-

SONIC Slippage Analysis:

Trading 8M SONIC (approx. $5.57M ) for USDC.e incurs a slippage of around ~ 8.35%.

-

stSONIC Slippage Analysis:

Trading 7.5 stSONIC (approx. $5.26M ) for USDC.e incurs a slippage of around ~ 8.37%.

USDT.e:

| Asset |

Liquidation Penalty (%) |

Supply Cap |

| SONIC |

15 |

4,000,000 |

| stSONIC |

15 |

3,800,000 |

-

SONIC Slippage Analysis:

Trading 4M SONIC (approx. $2.5M ) for USDT.e incurs a slippage of around ~ 4.27%.

-

stSONIC Slippage Analysis:

Trading 3.8M stSONIC (approx. $2.4M ) for USDT.e incurs a slippage of around ~ 3.53%.

SONIC Comet:

| Asset |

Liquidation Penalty (%) |

Supply Cap |

| stSONIC |

5 |

20,000,000 |

- stSONIC Slippage Analysis: :

Trading 20,000,000 stSONIC (approx. $13.7M) for SONIC incurs a low slippage of around ~ 0.4%.

Store Front Price Factor:

The Storefront Price Factor determines the fraction of the liquidation penalty that is allocated to buyers of collateral. The below factor is deemed appropriate as it provides a meaningful discount to encourage Liquidation participation while safeguarding the protocol against excessive risk.

| Market |

Store Front Price Factor |

| USDC.e |

60 |

| USDT.e |

60 |

| SONIC |

70 |

Reserve Parameter:

-

USDC.e:

Target Reserve: 20M USDC.e

Seed Reserve: 50k USDC.e

-

USDT.e:

Target Reserve: 20M USDT.e

Seed Reserve: 50k USDT.e

-

SONIC:

Target Reserves: 50M SONIC

Seed Reserves: 100k SONIC

IR Curve Analysis:

USDC.e & USDT.e Comets:

Chainrisk recommends the following parameters for the USDC.e and USDT.e Comets.

| Parameter |

Recommended Value |

| Annual Borrow Interest Rate Base |

0.015 |

| Annual Borrow Interest Rate Slope Low |

0.05 |

| Borrow Kink |

0.9 |

| Annual Borrow Interest Rate Slope High |

3.4 |

| Annual Supply Interest Rate Base |

0 |

| Annual Supply Interest Rate Slope Low |

0.054 |

| Supply Kink |

0.9 |

| Annual Supply Interest Rate Slope High |

3.034 |

At Optimal Utilization (90%), Borrow APR would be 6% and Supply APR would be 4.86%.

SONIC Comet:

Chainrisk recommends the following parameters for the SONIC Comet.

| Parameter |

Recommended Value |

| Annual Borrow Interest Rate Base |

0.01 |

| Annual Borrow Interest Rate Slope Low |

0.0353 |

| Borrow Kink |

0.85 |

| Annual Borrow Interest Rate Slope High |

1.46 |

| Annual Supply Interest Rate Base |

0 |

| Annual Supply Interest Rate Slope Low |

0.03329 |

| Supply Kink |

0.85 |

| Annual Supply Interest Rate Slope High |

1.3 |

At Optimal Utilization (85%), Borrow APR would be 4% and Supply APR would be 2.8%.

Incentive Parameters Analysis:

Upon the launch of a new market, low utilization rates are common. This recommendation aims to enhance lending/borrowing activity within the proposed Comets. We will monitor market responses closely to determine if further adjustments are necessary.

For USDC.e Comet:

| Daily COMP Supply Rewards |

5 |

| Daily COMP Borrow Rewards |

5 |

At 90% Utilisation:

- Borrow APR: 6%

- Supply APR: 4.86%

Given the current COMP price of ~ $50

- COMP Borrow Rewards: 1.76%

- COMP Supply Rewards: 1.57%

This results in the below Net APRs:

Net Borrow APY: 4.24%

Net Supply APY: 6.43%

For USDT.e Comet:

| Daily COMP Supply Rewards |

3 |

| Daily COMP Borrow Rewards |

3 |

At 90% Utilisation:

- Borrow APR: 6%

- Supply APR: 4.86%

Given the current COMP price of ~ $50

- COMP Borrow Rewards: 2.3%

- COMP Supply Rewards: 2%

This results in the below Net APRs:

Net Borrow APY: 3.7%

Net Supply APY: 6.86%

For SONIC Comet:

| Daily COMP Supply Rewards |

5 |

| Daily COMP Borrow Rewards |

4 |

At 85% Utilisation:

- Borrow APR: 4%

- Supply APR: 2.8%

Given the current COMP price of ~ $50

- COMP Borrow Rewards: 0.96%

- COMP Supply Rewards: 1.03%

This results in the below Net APRs:

Net Borrow APY: 3.04%

Net Supply APY: 3.83%

Note: Reflecting on the analysis given by @Gauntlet and the unfortunate backoff by Sonic Team, we are sharing some additional comments -

-

In Gauntlet’s Incentive Parameter Recommendation for the Sonic Comet (attached below), the COMP price should be $50, and the optimal utilization should be 85%. Hence, there is a value mismatch between Incentive Parameter Recommendation and IR Curve Parameter Analysis.

-

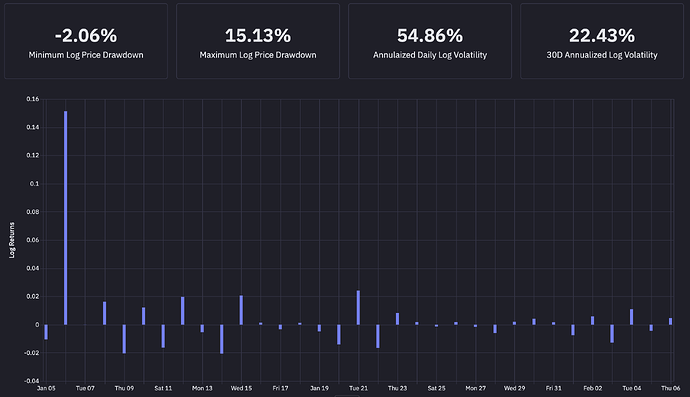

In the volatility analysis of the assets, Gauntlet has mentioned the ‘Maximum Log Price Drawdown’ as attached below. Drawdown is usually used to express the decline in price from the earlier higher point (crest) to the next lower point (trough). So, it can be assumed that the percentage will be negative since it is a movement from a higher to a lower position. However, as the image shows, the maximum log price drawdown is positive. Thus, a positive log price drawdown might mean a price increase, but this contradicts the usual definition of a drawdown. So, there is an error in the usual convention of the financial market. Also, the statistical notation was somewhat mixed up in the analysis.

-

Gauntlet Slippage Analysis focused on a single DEX, but using a DEX aggregator such as Odos could provide more accurate results. This concern was also highlighted by Franz in one of the above comments. Utilizing a DEX aggregator would allow for a more comprehensive assessment of slippage, liquidity and price impact across multiple DEXes.

-

The Sonic proposal was listed on the forum on 13th Dec and the recommendations from Gauntlet came on 6th Feb: close to 2 months later and after the community review on the parameters proposed, it has been more than 3 weeks without any update on parameters. This is in stark contrast to what happened to Aave, where Chaos Labs has promptly updated SONIC parameters after the initial community review. This isn’t just an issue with Sonic; every new chain deployment and proposal to add new collaterals is taking far too long. On top of that, the parameters are too conservative, which is shoving off a lot of avenues of revenue generation for Compound. We had highlighted this before and will highlight this now - again that a single risk provider is costing Compound community too much in opportunity cost.

-

We would recommend the Sonic Team to increase the incentives to $1m and deposit $10m to align with the incentives provided by other chains who are willing to deploy on Compound.

Next Steps

We invite community feedback on our risk recommendations and propose to push this to on-chain snapshot by coming weeks.

Regards

Team Chainrisk