Simple Summary

To facilitate community discussion and establish consensus regarding the next steps on Reserve Factors for Compound II, Gauntlet provides the following 3 options. Below, we outline the tradeoffs for each option in more detail. Gauntlet recommends that options 1 and 3 are the most prudent options. Since adjusting Reserve Factors is as much a matter of business strategy as it is of market risk, it is important for the community to find consensus.

- Decrease Reserve Factors by 0.025 for USDT and DAI

- Increase Reserve Factors by 0.025 for USDT and DAI

- Wait until Compound III is live

Motivation

The community made excellent points on the purpose of reserve factors and their utility beyond mitigating insolvencies. To continue the discussion with the community, we want to provide insights around important questions raised. As a point of clarification: we are aware that mechanics around reserves will change with Compound III. Nonetheless, we find the discussion around user elasticity relevant to optimizing protocol risk and returns. This analysis and recommendations focus specifically on Compound V2.

Before we dive into the discussion, let’s recenter on why the reserve factor is a valuable parameter in the first place. The reserve factor is an attractive parameter for navigating volatile markets since it can be set at the asset level (as opposed to other parameters like liquidation bonus which is global and applies at the protocol level). The reserve factor represents the portion of protocol revenues (paid by borrowers as interest) retained by the protocol as a liquidity backstop or insurance fund and potentially to supplement the treasury in the future based on community feedback. Reserve factors are generally viewed as supply side incentives because they are expressed as a portion of revenues not paid to suppliers. Conceptually though, the reserve factor is the delta between what the protocol takes in from borrowers and what it pays out to suppliers. A change in reserve factor could be passed along to borrowers as an incentive if an equivalent change were made to borrower interest curves. The reserve factor could therefore be used to incentivize either borrow or supply behaviors. Having robust models for this behavior is important, especially in times of high volatility, to set this parameter at optimal levels that maximize revenue for the protocol.

Specification

What drives reserve growth on Compound?

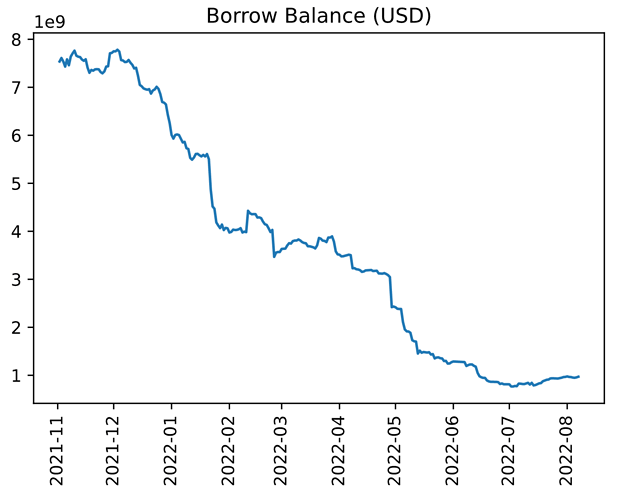

Reserves are a function of interest rates and total amount borrowed. As you can see in the graphs below, borrow usage on Compound has declined significantly in recent months. Since the reserve growth rate is driven by borrow balance, the annualized reserve growth has also declined.

Looking at the borrow balance by token, we observe that the USDC/USDT/DAI stablecoins represent nearly all of the borrowed value and the lion’s share of reserve growth. Since USDC will be part of the initial Compound III launch, any changes to reserve factors on Compound 2 for USDC would result in noisy data. We, therefore, chose to focus our analysis and recommendations on just USDT and DAI.

How might reserve factor changes impact borrower interest rates?

Reserve factors have not changed on Compound in a long time (since December 2020), and markets have changed significantly since then. Consequently, the protocol does not have accurate estimates of borrower and supplier elasticity with respect to reserve factors. In lieu of that, we have modeled the scenario of perfect elasticity to uncover what would happen if users reacted proportionately to the changes. We acknowledge this likely overestimates the true elasticity of users, who should be stickier for various factors like switching cost, relative risk level vs. alternative protocols, etc. This does illustrate the risk and potential upside of adjusting RF up or down. Borrower interest rates are a function of supplied liquidity, so we must first estimate the impact of the reserve factor on supply.

As explained in our previous post, to estimate the effect on supply, we use the following formula:

If the protocol increases reserve factors, we expect the amount supplied to decrease, driving up borrow usage and therefore borrow interest rates.

The borrower interest rate for the USDT/DAI stablecoins is calculated as the utilization ratio (total borrows / total supply) times a constant factor (a much larger constant factor is used once utilization surpasses 80%, but for simplicity, we will ignore this tail case for now) plus a constant base rate which the rate cannot fall below (currently set equivalent to 0).

For the purposes of this analysis, we assumed borrowers were unit elastic to the borrower interest rate. This enables us to compute the expected borrower interest rate that incorporates this change in supply, shown in the figure and table below:

The current reserve factors are indicated with black dots above: USDT is currently set to 0.075 while DAI reserve factor is set to 0.15. Some point estimates for borrower interest are outlined in the table below.

When benchmarked against rates in the market, borrower interest rates are already higher on Compound:

The current reserve factor USDT is lower than the market (.075 vs. .1). It is already higher for DAI (at .15 vs. .1). Raising reserve factors would increase the spread in the market between Compound and the market rate for both assets. Supposing any level of elasticity on the part of the users would project a decrease in borrows as a result (due to rising interest rates) at a time where our models show risk is well contained (Value at Risk, currently equal to essentially $0 at the 95% tail scenario). Given the decreased volume of total borrows as compared to previous quarters (reserves are projected to grow $2.5 million over the next year at its current growth rate), the opportunity cost of decreasing reserve factors is currently low, with the potential upside of driving borrows (calculation with unit elasticity below).

With risk well managed, this becomes predominantly a question of business strategy. We presented numbers in both directions (increasing and decreasing RF for the top 3 assets) to help inform the discussion, as we defer to the broader community regarding business strategy.

Several available options for Compound are:

-

Decrease Reserve Factors by 0.025 for USDT and DAI - since reserves are currently high enough to cover the 95% tail scenarios showing $0 VaR for all collateral assets, and borrows have sharply declined on the protocol, reducing Reserve Factors is an opportunity to bring interest rates close to the market rate with the goal of driving borrow activity while also gathering data around borrower and supplier elasticity. These assets are also not part of the initial Compound III roll-out and, therefore, relatively isolated from that market.

Limitations and Tradeoffs: Since we do not have data on borrower elasticity, we cannot model borrower behavior. If users are inelastic to interest rate changes, the reduced reserve factor might result in lost revenues for the protocol. This risk may be acceptable given the low borrow volume at the moment.

-

Increase Reserve Factors by 0.025 for USDT and DAI - proponents of this option may assume user behavior is inelastic to interest rates, therefore allowing the protocol to capture a larger share of the revenue. Any change in reserve factor would enable the community to gather data on user elasticity to build better models in the future.

While we support either option to gather data and improve models, Gauntlet does not recommend this option since any user elasticity with respect to this change would push interest rates farther away from the market rate as liquidity leaves the protocol.

Limitations and Tradeoffs: same as above - since we do not have data on elasticity, we cannot model behavior. If users are elastic to this change, an increase in reserve factor could result in decreased revenues for the protocol, the extent to which is unknown given the limited data.

-

Wait until Compound III is live - with the changing dynamics to be brought on by Compound III (reserve factor will no longer be set as a global parameter), the community may decide to wait to change reserve factors.

The tradeoff here is that we will collect no information on user elasticity.

We see options 1 and 3 as the most viable options. Our concerns are outlined under Option 2. We will initiate a Snapshot poll and look forward to further input and feedback from the community.

Next Steps

- Targeting a Snapshot vote on 8/15/2022 with the above 3 options.

By approving this proposal, you agree that any services provided by Gauntlet shall be governed by the terms of service available at gauntlet.network/tos.