Compound Migration Update (5/17/23)

Simple Summary

The previous two migration proposals have succeeded in attracting new users to the Ethereum v3 USDC comet.

However, as mentioned in our 4/21/23 Migration update, we were noticing and continue to notice a lack of v2 → v3 migration, for the same reasons why protocol growth as a whole in both Ethereum v3 and Polygon v3 is stagnating. We hypothesize that the reason for stagnant growth and migration is a combination of inefficient reward allocation relative to the currently unappealing v3 IR curves.

Instead of continuing to migrate rewards from v2 to v3, we view our recently posted Ethereum v3 USDC IR Curve Recommendations as Phase 3 of the migration, and can assess migrating more rewards from v2 to v3 after observing how users respond to the IR curve changes.

Recap of second migration proposal

Phase 2 of the V2 → V3 proposal was executed on 4/5/23, with the following changes:

- Decrease v2 daily USDC supply COMP rewards from 211.20 to 161.20 (-50)

- Decrease v2 daily USDC borrow COMP rewards from 211.20 to 161.20 (-50)

- Decrease v2 daily DAI supply COMP rewards from 211.20 to 161.20 (-50)

- Decrease v2 daily DAI borrow COMP rewards from 211.20 to 161.20 (-50)

- Increase v3 daily USDC borrow COMP rewards from 281.41 to 481.41 (+200)

As a result of the proposal, we saw the following net borrow APYs for stablecoins in the protocols on 4/6/23:

| v2 USDT | v2 USDC | v2 DAI | v3 USDC | |

|---|---|---|---|---|

| Borrow APY | 4.05% | 3.14% | 2.99% | 3.81% |

| Borrow Distribution | 0.43% | 1.12% | 1.40% | 5.86% |

| Net Borrow APY | -3.62% | -2.02% | -1.59% | +2.05% |

Below were the net borrow APYs for stablecoins in the protocols as of 5/16/23:

| v2 USDT | v2 USDC | v2 DAI | v3 USDC | |

|---|---|---|---|---|

| Borrow APY | 4.10% | 3.61% | 3.48% | 4.00% |

| Borrow Distribution | 0.00% | 0.89% | 1.27% | 3.31% |

| Net Borrow APY | -4.10% | -2.72% | -2.21% | -0.69% |

V3 supply & borrow trends since 4/4/23

Below are comparisons and time series of Total Collateral Supply, Total USDC Supply, and Total USDC Borrows from 4/4/23 to 5/15/23:

| 4/4/23 | 5/15/23 | % increase | |

|---|---|---|---|

| Total Collateral Supply | $300.0M | $381.8M | 27.3% |

| Total USDC Supply | $194.1M | $261.4M | 34.7% |

| Total USDC Borrows | $127.6M | $185.5M | 45.4% |

The USDC borrows peaked on 4/27/23 at $220M, and in the past few days have decreased to $185M.

Notable v2 non-recursive stablecoin borrowers

Below are the top v2 non-recursive stablecoin borrowers who still remain in the v2 protocol. Note that, despite decreased v2 stablecoin COMP distributions, none of these borrowers have left v2 since the beginning of the migration.

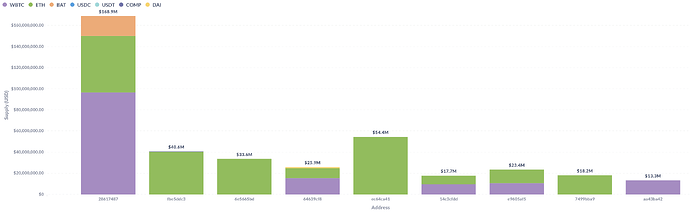

Notable v2 non-recursive borrowers’ supplies (5/15/23)

Notable v2 non-recursive borrowers’ borrows (5/15/23)

Next Steps

In our Migration CIP timeline, we recommended a 4-phase migration plan which assumed that users would migrate from v2 to v3 as a result of more appealing Net Borrow APRs from migrating rewards from v2 to v3. We previously executed two of the migration proposal phases on 3/6/23 and 4/5/23.

However, as noted in our 4/21/23 Migration update, we were noticing a lack of v2 → v3 migration, and the Polygon v3 USDC market was experiencing stagnant growth, in both cases despite appealing Net Borrow APRs. We hypothesized that the reason for stagnant growth and migration was a combination of inefficient reward allocation relative to the currently unappealing v3 IR curves.

Continuing with the reward migration as scheduled at that point would have not only been unproductive, but possibly risky in terms of losing v2 users. If users didn’t migrate from v2 → v3 before, there’s little reason to believe further reward migration would lead them to migrate. On the other hand, although no large non-recursive stablecoin borrowers have left v2, it’s possible that continuing to strip v2 rewards could cause some of those users to leave Compound entirely.

Therefore in the past several weeks we have shifted focus towards Incentive Optimization, first posting Polygon Compound v3 USDC Incentive Recommendations, and most recently posting Ethereum v3 USDC IR Curve Recommendations.

The Ethereum v3 USDC IR Curve Recommendations are meant to:

- Incentivize TVL growth as a whole in v3.

- Incentivize users to migrate from v2 → v3 even without added rewards.

- Ensure that v3 is as appealing as possible for v2 users for when we do migrate more rewards in the future from v2 → v3, thereby decreasing the chances of v2 users leaving Compound entirely when v2 rewards are further decreased.

The shift in Incentive Optimization focus to make IR curves and COMP rewards more efficient/appealing play a role in improving:

- v2 → v3 migration

- New & existing comet growth

- Long-term protocol profit

- Long-term COMP runway

Therefore we created the Gauntlet <> Compound Incentive Optimization proposal to officially make Incentive Optimization one of the services Gauntlet provides Compound.

In the meantime, we view the Ethereum v3 USDC IR Curve Recommendations as Phase 3 of the migration, and can assess migrating more rewards from v2 to v3 after observing how users respond to the IR curve changes.

By approving this proposal, you agree that any services provided by Gauntlet shall be governed by the terms of service available at gauntlet.network/tos.