Overview

During a period of sharp, market-wide price dislocations, Compound Comets demonstrated resilience and remained solvent. Intraday on October 10th, Bitcoin and Ethereum fell over 12% and 20% respectively. Liquidity thinned, spreads widened, and other tokens experienced significant drawdowns upwards of 50% before prices rebounded. Prices have since partially retraced, but the majority of industry assets have not returned to pre-shock levels.

On October 10th, the protocol absorbed and resolved 438 liquidation events and incurred no meaningful bad debt. Liquidation flows resulted in positive proceeds across multiple base assets, reflecting healthy liquidator participation and effective risk parameters.

Ethereum, for example, fell from $4,354 to a low of $3,435, most of the decline occurring within a thirty-minute timeframe.

Metrics

Compound Comets disbursed $40.65M in absorption payouts to borrowers during the drawdown. Among the various Comets, the V3 Ethereum USDC Comet accounts for the largest share of payouts, with $15.4 million, representing 38% of the total absorption.

- # of Liquidations: 438

- Bad Debt: < $1600 (primarily driven by liquidations on Unichain)

- Liquidation Proceeds Added to Reserves (in Base Token):

- USDC: 1,332,091

- USDT: 66,650

- WETH: 21.3

- USDS: 9,409

- USDe: 1,745

Note: Exact values may vary based on the snapshot block used.

Liquidations By Comet

| Comet | Liquidations |

|---|---|

| V3 Ethereum USDC | 113 |

| V3 Ethereum WETH | 19 |

| V3 Base WETH | 1 |

| V3 Polygon USDC.e | 6 |

| V3 Arbitrum USDC | 63 |

| V3 Base USDC | 23 |

| V3 Optimism USDC | 52 |

| V3 Optimism USDT | 21 |

| V3 Arbitrum WETH | 2 |

| V3 Arbitrum USDT | 37 |

| V3 Polygon USDT | 16 |

| V3 Ethereum USDT | 38 |

| V3 Optimism WETH | 1 |

| V3 Base Aero | 1 |

| V3 Ethereum USDS | 2 |

| V3 Mantle USDe | 4 |

| V3 Linea USDC | 1 |

| V3 Unichain USDC | 38 |

| Total | 438 |

Collateral Absorption Review

The following provides insights into how the most active Comets performed during the October 10th market downturn. Liquidations were timely on major markets with healthy liquidator participation. Gauntlet identified a notable delay between collateral absorption events and subsequent buyCollateral transactions on several networks. Reducing this lag helps limit price movement risk during volatile periods and improves overall capital efficiency.

Since deployment, the risk–reward profile on certain L2s has shifted. In particular, Ronin’s Comet shows persistently low user activity within a relatively weak DeFi ecosystem. Given limited organic demand and thinner external liquidity, the incremental risk to Compound is no longer justified by usage on that network. We recommend deprecating the Ronin Comet and focusing resources on markets with deeper participation and liquidity.

Participation remains healthy for Unichain, but liquidation timing can be optimized. Gauntlet plans to review incentive and parameter settings to shorten the interval between collateral absorption and liquidation completion, ensuring positions are resolved as quickly and efficiently as possible.

Total Absorption Events

Borrow Payouts by Native Token

USDC

USDT

WETH

USDS

USDe

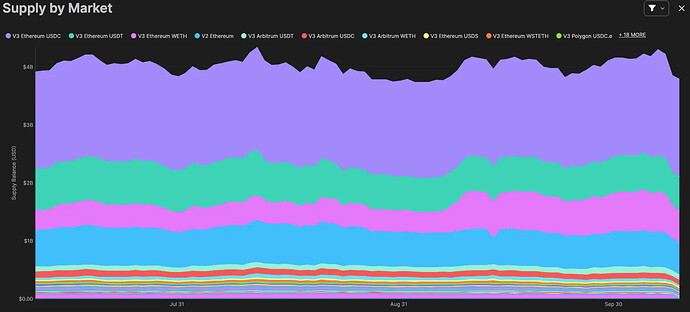

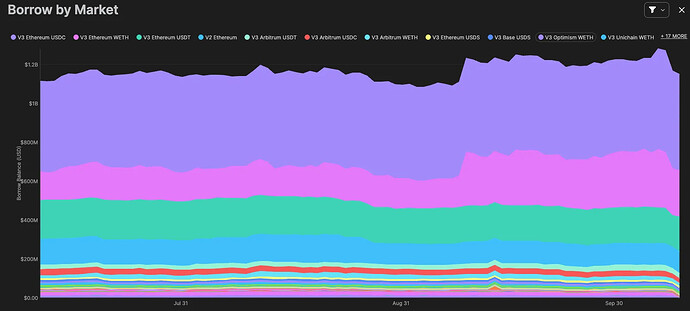

Supply and Borrow Trends

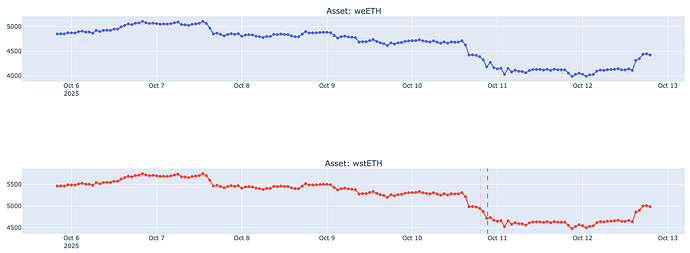

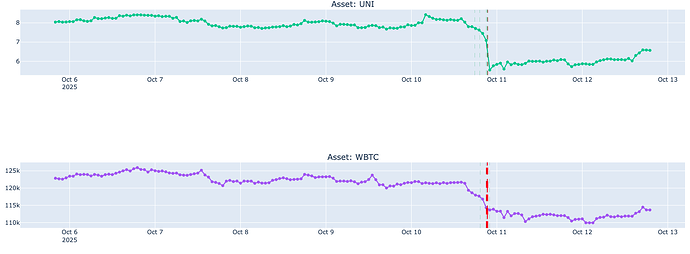

Collateral Price Changes over Time

Most collateral assets experienced sharp, correlated drawdowns during the October 10 downturn. ETH and BTC-denominated assets (WETH, WBTC, cbBTC, tBTC) declined by 10 to 20%, while other tokens such as UNI and LINK saw deeper intraday losses exceeding 30%. Staked and derivative ETH assets (rsETH, weETH, wstETH) tracked spot ETH closely, showing no meaningful depeg.

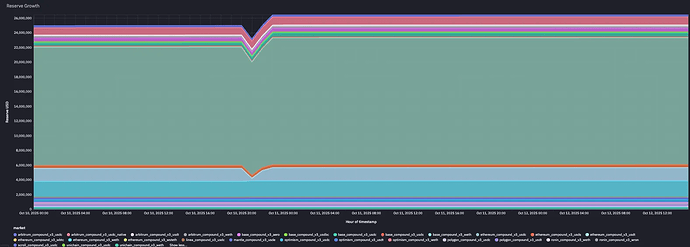

Reserve Growth

Overall

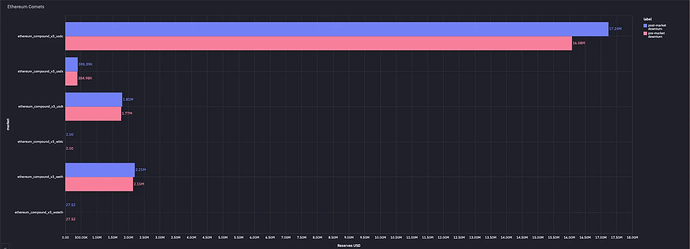

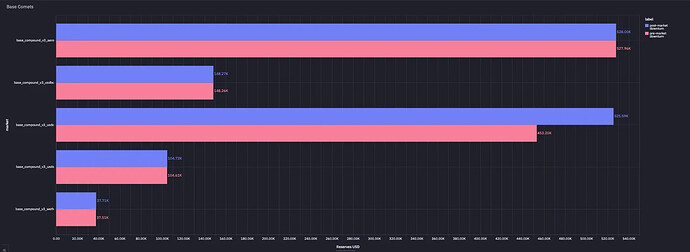

Protocol reserves increased following the October 10 market dislocation, reflecting positive liquidation proceeds and strong liquidator participation. Total reserves grew by approximately 1.33M USDC, 66.7K USDT, 21.3 WETH, 9.4K USDS, and 1.7K USDe across Comets (values depend on snapshot block). Most of these gains originated from Ethereum-based markets, with additional contributions from Arbitrum and Optimism.

The reserve decrease in the chart corresponds to the absorption and resolution window during peak volatility. Reserves rebounded afterward and continued their upward trajectory. This pattern reflects orderly liquidations and parameters that convert liquidation activity into net reserve gains rather than losses.

Ethereum

Base

Optimism

Polygon

Arbitrum

Unichain

Ronin - Unchanged

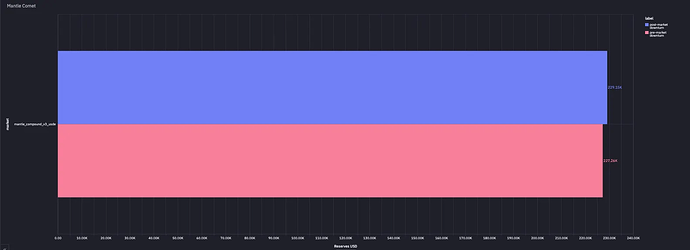

Mantle

Linea

Scroll

Summary:

Overall, the October 10th market drawdown triggered 438 liquidations on Compound, resulting in immaterial bad debt (less than $1.6k total, primarily Unichain). Liquidation activity more than offset this, adding ~$1.49 million (USD) to protocol reserves at Oct 10th intraday prices, reflecting healthy liquidator participation and effective risk parameters.

Actions

- Discuss deprecating Ronin Comets due to low demonstrated user demand and limited network growth since deployment

- Review and adjust Unichain liquidation parameters to ensure timely liquidations

- Continue active monitoring with follow-up analysis if conditions persist or change materially

Next Steps

- We welcome community feedback

- Gauntlet will continue to monitor markets and propose additional recommendations as required