As a result of the market downturn on February 3, 2025, from 01:47 UTC - 02:57 UTC, the Comets across Mainnet, Arbitrum, Base, and Optimism experienced zero insolvencies. Instead, the comet’s reserves increased as a result of healthy liquidations.

A key trend observed in liquidations across these Comets is that WETH and wstETH collateral were held for longer periods before being sold. This sequencing is not ideal, as the Comet may have only been able to offload the collateral due to WETH’s upward price movement post-absorption. If WETH or wstETH had instead trended downward, it could have resulted in insolvencies, as liquidators would struggle to profit from asset sales. Below we’ve outlined key metrics during the downturn and how the comet has handled liquidations.

Mainnet USDC Comet

Topline Metrics

- Collateral (USD) absorbed: $77.83M

- The total USD value of collateral seized by the comet when users’ HFs dropped below 1.0

- USDC paid to absorbed users (comet losses): $71.99M

- Whenever the comet seizes a user’s collateral, it repays them a discounted amount in USDC based on the Liquidation Penalty of the user’s assets. These USDC repayments can be viewed as the comet’s losses, and the comet needs to sell the absorbed collateral for at least this amount of USDC to avoid insolvencies.

- USDC received from liquidators (comet gains): $74.72M

- The total USDC that collateral purchasers paid for the auctioned collateral.

- USDC surplus (comet reserve growth): $2.72M

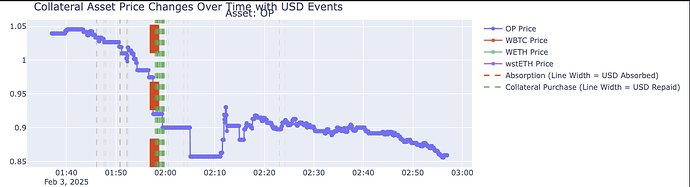

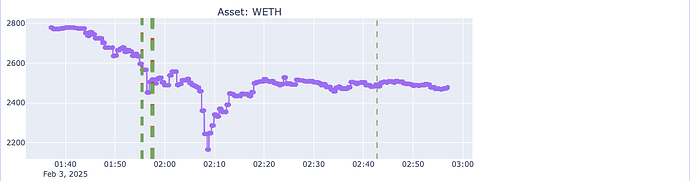

The chart above illustrates the time series of WBTC and WETH collateral prices during significant absorption and repayment events. Red vertical lines indicate absorption events, while green vertical lines represent collateral purchases by liquidators. The width of the lines reflects the magnitude of the liquidation or repayment. From the chart, it is evident that a large WBTC position was absorbed and repaid primarily within the same timestamp, while WETH absorptions were occasionally repaid over several minutes.

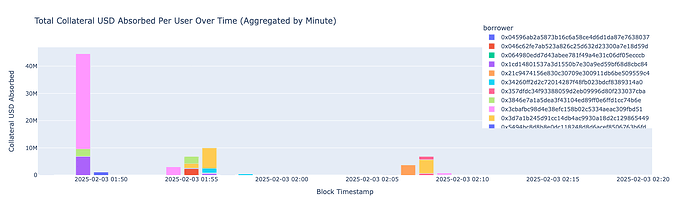

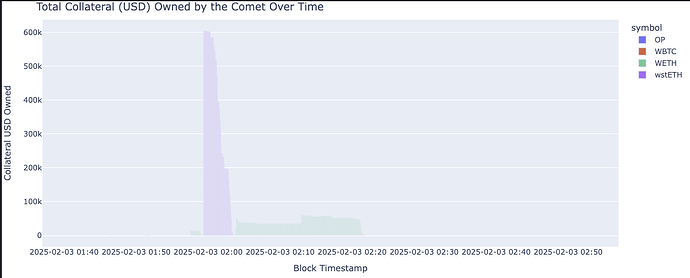

A more detailed breakdown of the collateral absorptions and repayments is provided in the charts above. Approximately $17M of WBTC was absorbed and repaid within the same timestamp. In contrast, the $20M WETH absorption, followed by an additional $15M WETH absorption and $3M wstETH absorption, took longer to be repaid. This delay may be due to the fact that WBTC’s 10% liquidation penalty is more attractive to liquidators compared to the 5% penalty for WETH and the 8% penalty for wstETH. The final chart, “Total Collateral (USD) Owned by the Comet Over Time,” shows that the comet held over $10M in unsold WETH for 7 minutes and $3M in unsold wstETH for more than 10 minutes. Fortunately, during this period, the prices of both assets appreciated, preventing insolvencies and instead resulting in net reserve growth, as shown below:

However, there may come a time in the future when unsold collateral leads to insolvencies if the collateral price drops significantly after absorption. As outlined in our Analysis of the Compound v3 Absorption Mechanism, the v3 absorption mechanism offers much less of a buffer against insolvency compared to the v2 mechanism. As a result, we will recommend increasing the liquidation penalty values for both WETH and wstETH in a future recommendation.

Mainnet USDT Comet

Similarly, in the USDT Comet, there were no insolvencies. The following are the top-line metrics:

- Collateral (USD) absorbed: 2.87M

- Base tokens received from liquidators (revenue): 2.80M

- Base tokens paid to absorbed users (losses): 2.68M

- Base tokens remaining in protocol (profit): 124.64K

- Percentage profit: 4.35%

- Aggregate liquidation penalty: 6.66%

The chart shows that a large WBTC position was absorbed and repaid almost instantly within the same timestamp, whereas similarly, in the case of WETH absorptions were sometimes repaid over a longer period, spanning several minutes.

The cumulative USDT owned by the protocol mirrors similar outcomes as observed for the USDC comet, where the comet was able to sell the collateral assets due to the upward price trajectory of WETH.

The comet held over $700K in unsold WETH for 10 minutes.

Mainnet USDS Comet

No liquidations took place in the USDS Comet

Optimism USDC Comet

Top-line metrics for USDC Comet:

-

Collateral (USD) absorbed: 819.38K

-

Base tokens received from liquidators (revenue): 774.03K

-

Base tokens paid to absorbed users (losses): 742.08K

-

Base tokens remaining in protocol (profit): 31.95K

-

Percentage profit: 3.90%

-

Aggregate liquidation penalty: 9.43%

Optimism USDT Comet

Top-line metrics for the USDT Comet

- Collateral (USD) absorbed: 348.26K

- Base tokens received from liquidators (revenue): 311.88K

- Base tokens paid to absorbed users (losses): 289.15K

- Base tokens remaining in protocol (profit): 22.73K

- Percentage profit: 6.53%

- Aggregate liquidation penalty: 16.97%

Base USDC Comet

Top-line metrics for the USDC Comet:

- Collateral (USD) absorbed: 1.48M

- Base tokens received from liquidators (revenue): 1.47M

- Base tokens paid to absorbed users (losses): 1.42M

- Base tokens remaining in protocol (profit): 52.68K

- Percentage profit: 3.57%

- Aggregate liquidation penalty: 3.62%

BASE AERO Comet

No liquidations took place on the AERO comet

Arbitrum USDT Comet

Top-line metrics:

-

Collateral (USD) absorbed: 3.05M

-

Base tokens received from liquidators (revenue): 2.94M

-

Base tokens paid to absorbed users (losses): 2.87M

-

Base tokens remaining in protocol (profit): 72.40K

-

Percentage profit: 2.37%

-

Aggregate liquidation penalty: 6.06%

On the USDT Comet, WETH collateral remained unsold for over 45 minutes.

Arbitrum USDC Comet

Top-line metrics:

- Collateral (USD) absorbed: 29.96K

- Base tokens received from liquidators (revenue): 28.66K

- Base tokens paid to absorbed users (losses): 27.80K

- Base tokens remaining in protocol (profit): 864.93

- Percentage profit: 2.89%

- Aggregate liquidation penalty: 7.22%

On Arbitrum, WETH collateral remain unsold for over 40 minutes since the time of absorption.

Next Steps

- Given the above data, we recommend increasing Liquidation Penalties for WETH and wstETH to further incentivize liquidators to offload these assets from the Comet. Gauntlet will follow-up with further recommendations on this.

- We welcome community feedback