In the face of a significant market downturn, Compound Comets demonstrated notable resilience. During this period, major collateral assets encountered substantial declines in market prices. Despite these adverse conditions, the Compound protocol successfully avoided any insolvencies.

Notably, Wrapped Ether (WETH) experienced a sharp 15% price drawdown within just 9 minutes, as reported by our oracle feeds. This rapid fluctuation underscores the volatility inherent in the current market environment.

Collateral Absorption by Comet

During the downturn, Compound’s Comets disbursed a total of $46.4M in absorption payouts to borrowers. Among the various Comets, the Ethereum USDC Comet accounted for the largest share of these payouts, with $33 million, representing 70% of the total absorption.

Comp v3 Absorption Events

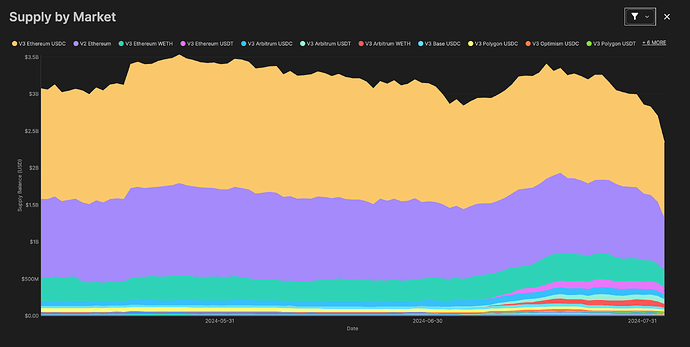

The recent market downturn resulted in a notable outflow of positions and depreciation of collateral assets within Compound’s supply and borrow markets. According to Defillama, Compound experienced a 10% decline in Total Value Locked (TVL) as a consequence of this market stress.

During the period of market stress, Compound v3 recorded a net reserve growth of $1 million. This increase is primarily due to the liquidity obtained through the liquidation process. The accompanying chart provides the reserve growth for base tokens within each Comet:

Ethereum Reserve Growth

Arbitrum Reserve Growth

Base Reserve Growth

Polygon & OP Reserve Growth

Excluding the BASE USDC and USDbC Comets, all other Comets have demonstrated growth in their reserves as a result of liquidations within their respective markets. Currently, the BASE USDC and USDbC Comets are experiencing negative base reserve growth. However, there remains a substantial amount of collateral reserve in WETH that has yet to be bought to facilitate the repayment of absorption payouts.

The table below illustrates that there is a significant reserve of WETH collateral available. This collateral has the potential not only to cover the existing shortfall but also to potentially augment the reserves of the Comets.

| Comets | Current Reserves | WETH Collateral Asset | Estimate Reserves post Collateral Purchase |

|---|---|---|---|

| BASE USDC Comet | -$40.2k | $225.07k | $173k |

| BASE USDbC Comet | $108k | $21.2k | $128k |

Comet Market Downturn Performance

This analysis presents detailed insights into the performance of the most active Comets during the recent market downturn. Gauntlet wants to highlight a notable delay between the collateral absorption event and the subsequent buyCollateral transaction for several L2s. Despite favorable liquidity conditions, it took liquidators hours to purchase absorbed collateral

We will conduct a more comprehensive analysis to better understand these delays. However, it is crucial for the Compound community to address and mitigate these latency issues to minimize prolonged risk exposure to the protocol. Reducing the time between collateral absorption and buyCollateral events is essential to enhance the protocol’s resilience and operational efficiency.

Ethereum USDC

- Collateral (USD) absorbed: 34.38M

- Base tokens received from liquidators (revenue): 33.27M

- Base tokens paid to absorbed users (losses): 32.54M

- Base tokens remaining in protocol (profit): 734.87K

- Percentage profit: 2.14%

- Aggregate liquidation penalty: 5.37%

Ethereum USDT

- Collateral (USD) absorbed: 3.91M

- Base tokens received from liquidators (revenue): 3.79M

- Base tokens paid to absorbed users (losses): 3.70M

- Base tokens remaining in protocol (profit): 87.20K

- Percentage profit: 2.23%

- Aggregate liquidation penalty: 5.33%

Note it did take roughly 15 minutes for a majority of the initial absorbed collateral to be purchased.

Optimism USDC

- Collateral (USD) absorbed: 795.69K

- Base tokens received from liquidators (revenue): 769.63K

- Base tokens paid to absorbed users (losses): 749.56K

- Base tokens remaining in protocol (profit): 20.07K

- Percentage profit: 2.52%

- Aggregate liquidation penalty: 5.80%

Note it took roughly 4 hours for a majority of the initial absorbed collateral to be purchased.

Optimism USDT

- Collateral (USD) absorbed: 338.38K

- Base tokens received from liquidators (revenue): 333.59K

- Base tokens paid to absorbed users (losses): 321.52K

- Base tokens remaining in protocol (profit): 12.08K

- Percentage profit: 3.57%

- Aggregate liquidation penalty: 4.98%

Note it took roughly 4 hours for a majority of the initial absorbed collateral to be purchased.

Arbitrum USDC Native

- Collateral (USD) absorbed: 170.73K

- Base tokens received from liquidators (revenue): 164.43K

- Base tokens paid to absorbed users (losses): 160.09K

- Base tokens remaining in protocol (profit): 4.34K

- Percentage profit: 2.54%

- Aggregate liquidation penalty: 6.23%

Arbitrum USDT

- Collateral (USD) absorbed: 1.81M

- Base tokens received from liquidators (revenue): 1.73M

- Base tokens paid to absorbed users (losses): 1.67M

- Base tokens remaining in protocol (profit): 55.31K

- Percentage profit: 3.05%

- Aggregate liquidation penalty: 7.86%

Base USDC

- Collateral (USD) absorbed: 3.53M

- Base tokens received from liquidators (revenue): 3.20M

- Base tokens paid to absorbed users (losses): 3.28M

- Base tokens remaining in protocol (profit): -75128.70

- Percentage profit: -2.13%

- Aggregate liquidation penalty: 7.03%

Note the comet still has WETH able to be sold to recover the reserves they paid upon absorption events that occurred earlier in the morning.

Polygon USDT

- Collateral (USD) absorbed: 56.92K

- Base tokens received from liquidators (revenue): 53.92K

- Base tokens paid to absorbed users (losses): 53.05K

- Base tokens remaining in protocol (profit): 873.65

- Percentage profit: 1.53%

- Aggregate liquidation penalty: 6.79%

Polygon USDC.e

- Collateral (USD) absorbed: 923.61K

- Base tokens received from liquidators (revenue): 896.26K

- Base tokens paid to absorbed users (losses): 854.96K

- Base tokens remaining in protocol (profit): 41.30K

- Percentage profit: 4.47%

- Aggregate liquidation penalty: 7.43%

Next Steps

- Welcome community feedback and input

- Gauntlet will continue to monitor markets and make any necessary risk-off recommendations if market requires.