[Gauntlet] BASE v3 WETH Update (11/03/2023 - 11/09/2023)

Gauntlet would like to provide the community with an update on metrics from the BASE v3 WETH comet over the past week.

Simple Summary

- WETH Borrows are up 1.89%, from 1.36k ($2.88M) to 1.38k ($2.93M).

- WETH Supply is down 5.68%, from 5.55k ($11.95M) to 5.21k ($11.28M).

- WETH utilization increased 8.02%, from 24.1% to 26.0%.

- The minimum WETH reserve growth was -50.6%, and the maximum was -43.4%. The average WETH reserve growth was -46.5%.

- The comet accumulated $-0.45k WETH reserves while distributing $7.06k COMP rewards for a weekly Net Protocol Profit of $-7.5k.

Analysis

Below are metrics of the market and parameters over the past week. Note that collateral supply values are normalized to end date token prices, in order to get an idea of intentional user behavior as opposed to fluctuations in underlying token prices.

Market Growth

Total Collateral (USD) is up 2.85%, from $3.14M to $3.23M.

WETH Supply is down 5.68%, from 5.55k ($11.95M) to 5.21k ($11.28M).

WETH Borrows are up 1.89%, from 1.36k ($2.88M) to 1.38k ($2.93M).

WETH utilization increased 8.02%, from 24.1% to 26.0%.

Supply Caps

Above are the current supply cap utilizations for each collateral asset.

Above is a time series of supply cap utilization for each asset over the past week.

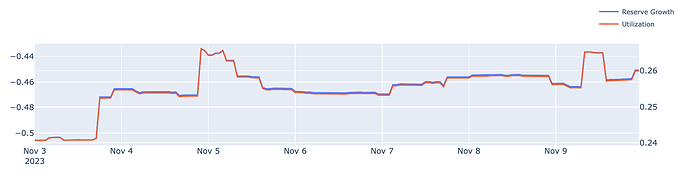

Utilization and Reserves

The minimum WETH utilization was 24.1%, and the maximum was 26.6%.

The minimum WETH reserve growth was -50.6%, and the maximum was -43.4%. The average WETH reserve growth was -46.5%.

The comet accumulated $-0.45k WETH reserves while distributing $7.06k COMP rewards for a weekly Net Protocol Profit of $-7.5k.