Greetings.

Its been a few months since I have last spoken about cCOMP and the oddities that the market contains.

While originally I came into this topic hoping to make some quick and sharp changes regarding either the interest rate parameters, borrow cap, or even the cfactor. But as it usually is, hastily made decisions don’t always hold the most predictable consequences.

This journey led me to learn about what it really means to be your own bank, the difference between stealing and being educated, and how to use SQL.

I want to thank the grants committee for helping me out financially and giving me the resources and the assistance I needed along the way.

So what does being your own bank mean?

I think this idea came from bitcoin, where individuals would instead manage their own accounts on a distributed ledger, instead of on a bank’s internal ledger, or even on the central banks ledger.

Sure, that’s not all a bank does, but that’s all bitcoin could do at the time

That idea was enough for many at the time, because that’s all that the decentralized financial world could offer at the time, a ledger. But the year is 2021, not 2009 and the financial resources have vastly expanded on decentralized computing systems

Now that we have Compound Finance, other “self driving banks”, derivatives and liquid automated markets, the idea of being your own can be one of two options.

Stay the same, (Stacking Sats)

or…

Everyone can individually learn how to act like a financial institution, balancing assets, liabilities, equity, derivatives and liquidity requirements.

Ok, so the first option is too simple. (Some people like alt coins, are degens, spend hours of their days away from loved ones to read “charts” and draw lines with crayons on their computer screens). If you are here on this forum, you have at least understood the idea of the time value of money, the importance of generating yields, cash flow, and maybe a bit more.

So how do you be your own bank using defi?

What does a bank even do?

-

Borrow Low, Lend high

-

Reduce their risk (optional)

What does a banks balance sheet look like?

Assets = Liability + Equity

Here is an example of a sample bank’s balance sheet.

Some of these terms are fairly interchangeable within the defi space

-

Borrowings (DAI)

-

Lending (ctokens)

-

equity (COMP?)

Some are less interchangeable

-

An individual using compound is not going to have their Assets = Liabilitys, because of the cFactors

-

(even with a high cFactor (.75) the balance sheet will not be balanced)

-

Reserves (Compound has reserves, and COMP holders/governance can sweep reserves, but it is not the same)

Lets say you wanted to comp farm/recursively lend.

What would your balance sheet look like?

Lets say you have 100 USDC (cfactor 0.75) (borrowing DAI/USDC)

…

Blue: Lending Position (Total)

Gray: Lending Position from Recursive Borrows

Orange: Debt

Confusing Right? Being a bank is difficult. Here is a “simple” ETH recursive lending situation, only borrowing and lending ETH. See how our COMP returns are higher because of our enlarged position?

| ETH | Price | cFactor | Supply APY | Distrobution APY | Borrow APY | Distrobution APY | |||

|---|---|---|---|---|---|---|---|---|---|

| 1 | 2495 | 75.00% | 0.15% | 0.42% | 3.05% | 6.90% | |||

| 1/(1-cf) | |||||||||

| Net Supply APY | Net Borrow APY | ||||||||

| 0.57% | 3.85% | ||||||||

| Supply | Borrow | ||||||||

| 0.15% | 4 | 3 | 3.05% | ||||||

| COMP in ETH | 0.0168252 | 4.006 | 3.0915 | 0.2133135 | COMP in ETH | ||||

| 0.2301387 | 4.2361387 | ||||||||

| Effective APY | 5.903% | ||||||||

| Deleveraged APY | 23.61% |

The interesting thing to note is that the higher your borrow rate is, the higher your debt will become, collecting even more COMP.

Before the first COMP speed patch, comp returns would be highest wherever the borrow APY is highest, and to some extent (keeping market comp speeds constant) that would be the same as it is today.

Now that we have some of this out of the way, now we can move on to the cComp market and actually view it from the BYOB perspective

Below is a graph of ccomp utilization (borrows/supplied)

This determines the interest rate.

But why is the UTIL constantly going down?

What are those bumps?

Glad you asked:

UTIL is going down because there is a borrow cap (Currently ~92k COMP) and the multisig controlling the caps feels like raising it would be overstepping their duties.

The bumps are 1 of two things

-

Repayments of debt

-

change in borrow cap and immediate borrow

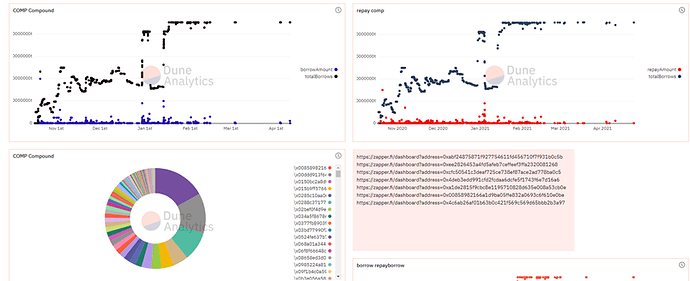

Below is a dashboard I made on dune showing Borrows, Total Borrows, Repayments, and largest borrowers.

How profitable are their positions?

Starting with 71k in COMP borrowed (They had enough collateral after the upswing in two collateral assets ETH + WBTC)

These accounts have been active for a while and are obviously LONG on COMP.

| COMP | Price | cFactor | Supply APY | Distrobution APY | Borrow APY | Distrobution APY | |

|---|---|---|---|---|---|---|---|

| $657.00 | 0.6 | 0.83% | 2.23% | -6.80% | 14.08% | ||

| Formula | |||||||

| 1/(1-cf) | Net Supply APY | Net Borrow APY | |||||

| 3.06% | 7.28% | ||||||

| Borrowed By Followed Addresses | |||||||

| 71059.3963 | |||||||

| $46,686,023.37 | |||||||

| Supply | Borrow | ||||||

| $46,686,023.37 | |||||||

| 3.06% | $116,715,058.42 | $70,029,035.05 | -6.80% | ||||

| $120,286,539.21 | $74,791,009.44 | Debt Size | |||||

| $130,817,113.34 | In COMP | $10,530,574.13 | From leveraged Borrow |

At the end of the day, not only does “locking” in this position generate a lot of comp as “income”, but their position size for COMP is essentially tripled. So if comp goes up in price, as it has in the past their exposure is high and risk is low.

Obviously these individuals/organizations have a great understanding of how COMP speeds work and possibly knew about the borrow cap (Although none are on the multisig - so no conflict of interest)

But the real advantages they had were their understandings of leverage, the power of recursive lending and the idea of a carry trade.

The idea of being your own bank brings a lot of power and a lot of responsibility, but because these tools are available for all of us within the DeFi world, we should all try to learn from the banks, in order to mimic them and become even more profitable.

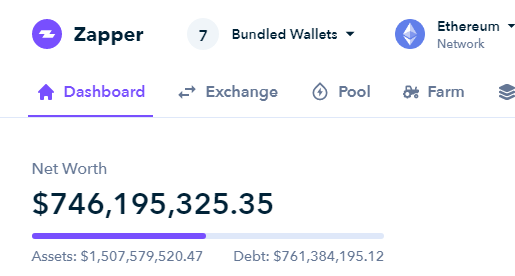

Below are the “balance sheets” of seven of the larger whales in compound.

Take a look at how they balance their assets and liabilities, making sure both are profitable.

I welcome all comments and will try to answer as many questions as possible. This took me probably close to 100+ hours talking to people, digging rabbit holes, and messing around on testnets. (I am sorry for breaking Kovan). My goal here is to stir up conversation, research and intellectual debates. I am not trying to spread FUD, all funds are safe and there has been no foul play. Compound has been amazing in helping me do research and answer and and all questions I asked. Not Financial advice, please don’t sue.

COMP Delegation/tips: 0xba2ef5189B762bd4C9E7f0b50fBBaB65193935e8

if you like what you read and want to donate or check out other projects I’m working on, peep here

…