[Gauntlet] Weekly Market Update: Arbitrum USDC (7/21/23 - 7/28/23)

Gauntlet would like to provide the community with an update on metrics from the Arbitrum USDC comet over the past week and will include any relevant recommendations.

Simple Summary

- Gauntlet recommends decreasing the daily COMP supply rewards from 34.73 to 10 (~$614k annual savings). Compound Labs is working on launching a native USDC comet on Arbitrum, to migrate liquidity from this comet to be deprecated to the new comet.

- USDC borrows are up 33.6%.

- USDC supply is down 6.4%.

- The comet lost $663 in USDC reserves over the past week, with an average reserve growth of -56.4%.

- The comet distributed $19.17k COMP rewards over the past week, for a Net Protocol Profit of -$19.83k.

Analysis

Below are metrics of the market and parameters over the past week.

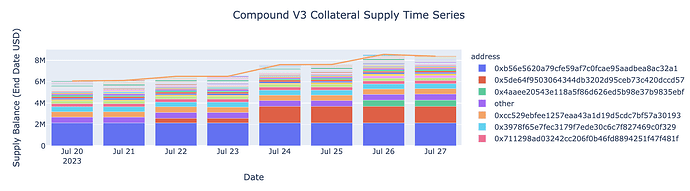

Market Growth

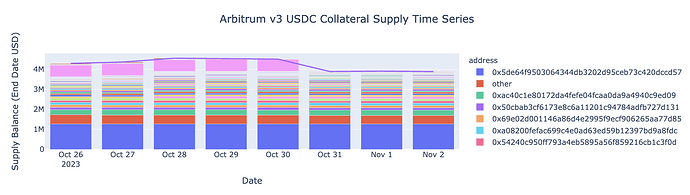

Total Collateral (USD) is up 38.0%, from $6.08M to $8.39M.

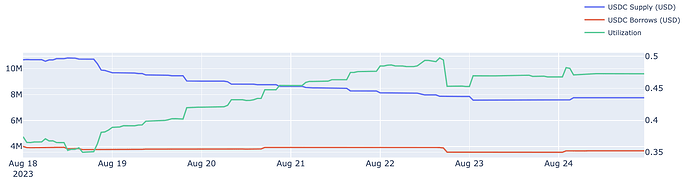

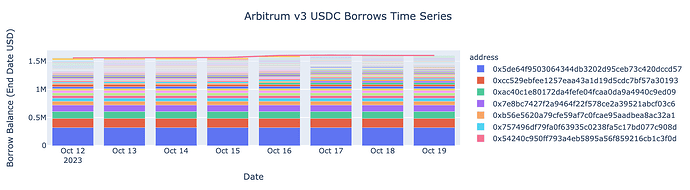

USDC Borrows are up 33.6%, from $2.32M to $3.10M.

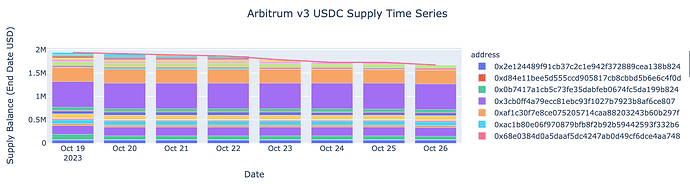

USDC Supply is down 6.4%, from $16.28M to $15.24M.

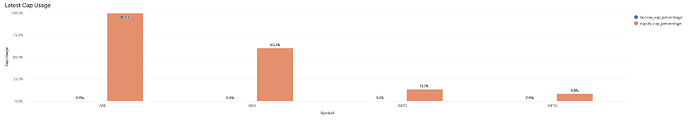

Supply Caps

Above are the current supply cap utilizations for each collateral asset.

Above is a time series of supply cap utilization for each asset over the past week.

Utilization and Reserves

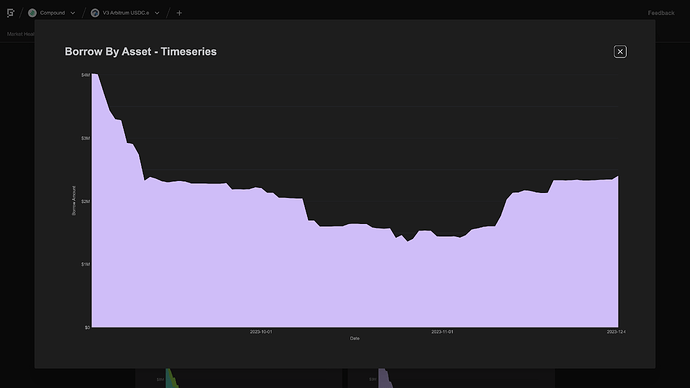

The minimum USDC utilization was 14.1%, and the maximum was 21.2%.

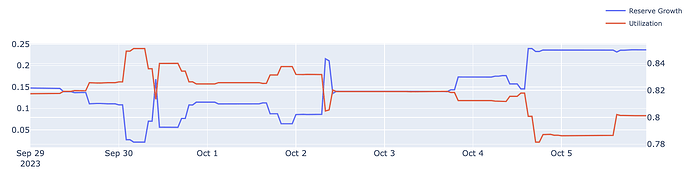

The minimum USDC reserve growth was -62.9%, and the maximum was -44.9%. The average USDC reserve growth was -56.4%.

The comet lost $663 in USDC reserves while distributing $19.17k COMP rewards, for a weekly Net Protocol Profit of -$19.83k.

Recommendations

Gauntlet recommends decreasing the daily COMP supply rewards from 34.73 to 10 (~$614k annual savings). Compound Labs is working on launching a native USDC comet on Arbitrum, to migrate liquidity from this comet to be deprecated to the new comet.

Currently, the Earn Distribution is 6.09%, with $14.05M USDC supply and 31.27% utilization. The USDC supply is overly incentivized, losing $19.17k daily COMP rewards. Given the current $14.05M USDC supply, decreasing the daily COMP supply rewards to 10 will dilute the Earn Distribution to 1.77%, resulting in a Net Earn APR of 2.78%. If the USDC supply decreases to $10M, the resulting Earn Distribution will increase to 2.48%, resulting in a Net Earn APR of 3.49%, utilization of 43.9%, and Borrow APR of 3.04%.